Sales

Traditional Summer dip sees asking prices fall for first time this year – Rightmove

"Prices usually drop in August, and this 1.3% drop is on a par with the average August drop over the past ten years," explains the Rightmove team.

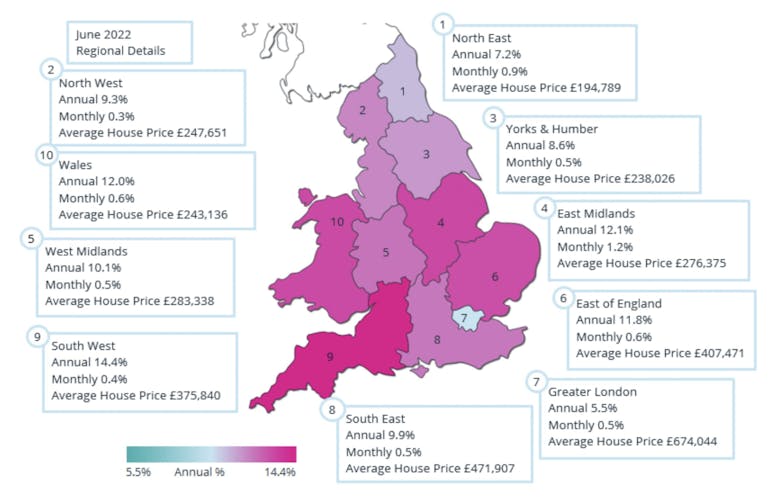

Heatmapped: Housing market continues to confound, as prices rise again

Annual price growth increased to 10.2% in England & Wales last month, reports Acadata.

House prices continue to climb despite falling buyer demand – RICS

"It is little surprise that housing market activity is now losing some momentum," says the RICS - but most surveyors "still anticipate prices will be modestly higher than current levels in a year’s time.

Market towns see property prices dip as the countryside property boom cools

After two years of punchy growth, house prices in 25 regional market towns have fallen by an average of 2% in the last 12 months.

Ranked: London’s most active property markets

Croydon (CR0), Wandsworth (SW18) and Merton (SW19) are the most active London areas for home-buying activity, with each postcode seeing more than 60 homes sold each month.

High-end country estate market on a roll

Nine sales of £15mn-plus estates have been recorded across England & Wales so far this year.

London’s sales pipeline swells as number of offers accepted hits ten-year high

Pipeline now stronger than it was in the final months of the stamp duty holiday in 2021, reports Knight Frank.

No sign of price slowdown in Prime London – LonRes

High-end market continues to hold its own despite wider economic context, with demand staying high and stock levels still low…

Monday Market Review: Key figures and findings from the last seven days (w/c 01.08.22)

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, Savills, Coutts, Zoopla, Knight Frank, London House & more…

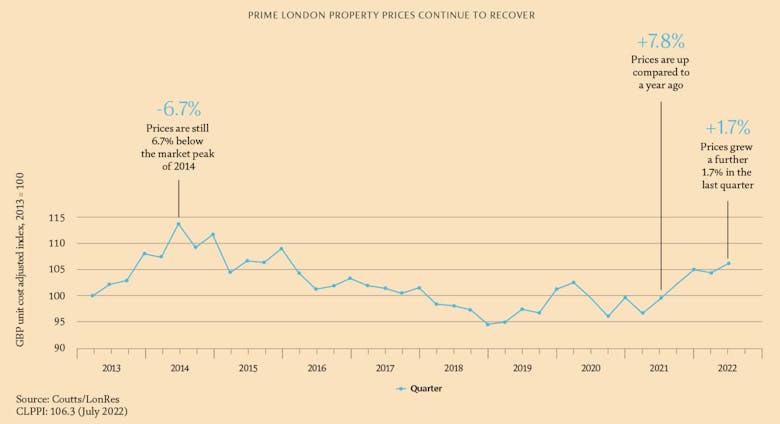

‘London’s prime property market is getting back on form’ – Coutts

High-society bank tells affluent clients that PCL is back in action.

Savills halves PCL price forecast for 2022

Prime Central London's property market recovery is taking longer than expected, says Savills, as it downgrades its forecast for this year.

Prime London sales market in ‘best shape since 2014’

New analysis finds the prime postcodes in rebalancing mode, with some encouraging signs, but the market is expected to soften as we head deeper into H2.