Sales

Tom Bill: Don’t read too much into current UK housing market data

KF's UK resi research chief explains why we are unlikely to see much clarity on the longer-term trajectory for house prices until March next year...

Prime London property buyers ‘are hesitant but haven’t disappeared’

Knight Frank's latest analysis of the prime London property market tells of a clear slowdown in buying activity - but a price crash seems unlikely.

Economists predict ‘at least 10%’ slump for UK & US house prices next year

Credit Suisse has reiterated its prediction of a significant correction for global house prices.

Property transactions likely to drop by more than fifth in 2023 – UK Finance

Britain's banking trade body expects the housing market to return to pre-pandemic activity levels next year.

Vintage year for high-value country house market as sales hit 15-year high

Wealthy domestic buyers after a lifestyle change have been capitalising on the relative value on offer, reports Knight Frank.

‘When you factor in cash and mortgaged transactions, the picture is less bleak’

Cash-based transactions are a significant part of the overall market and key in sustaining prices, notes Acadata.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Jackson-Stops, UK Finance, Zoopla, Knight Frank, Savills, Rightmove & more...

Rightmove predicts 2% drop for house prices next year

Asking prices are falling as 'sellers who are determined to find a buyer quickly adjust their expectations and adapt to a less frenzied housing market,' says Rightmove, as the portal predicts a 'relatively…

Prime Country Homes are not in a ‘cappuccino market’: Estate agency predicts only a ‘minor adjustment’ for house prices next year

Jackson-Stops thinks house prices will dip in some markets next year, before returning to positive growth in 2024.

Global agent survey reveals top buyer trends to watch

Savills agents around the world report on the impact of shifting sentiment in their markets, and the properties and features most in-demand post-pandemic...

Real estate markets will see ‘green shoots of recovery’ by the end of 2023, predicts CBRE

'The clouds will begin to break later in the year,' says CBRE's research chief, Jennet Siebrits.

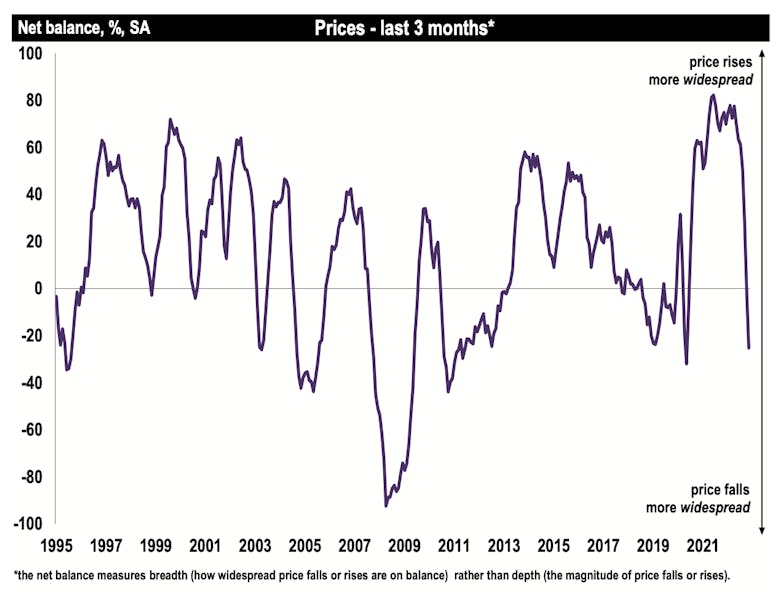

House prices fall as the property market continues to slow – RICS

'The downturn in the housing market this time could be shallower compared with past experiences,' says Simon Rubinsohn, Chief Economist at the Royal Institute of Chartered Surveyors.