Policy

Landlords could get EPC upgrade extension

A proposed deadline to require all rental homes to achieve an EPC grade of C or above may be pushed back...

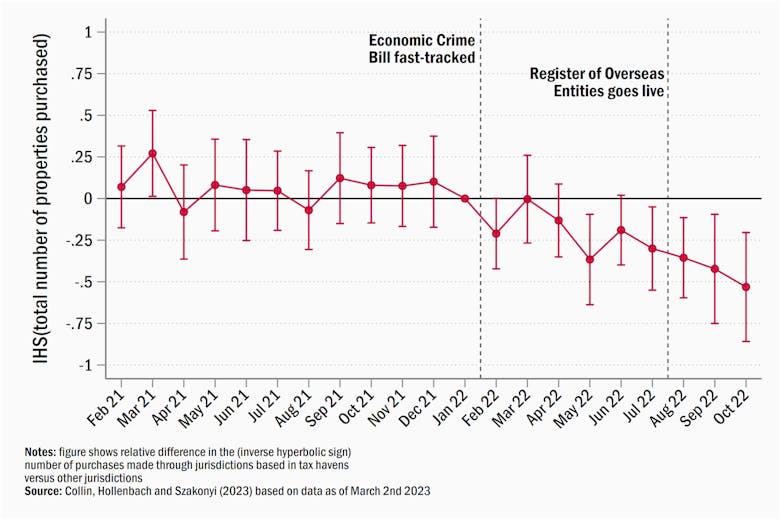

The Register of Overseas Entities seems to be working, as UK property deals involving tax havens fall

New research suggests improved transparency in the property market means 'Londongrad' is losing its appeal to corrupt money...

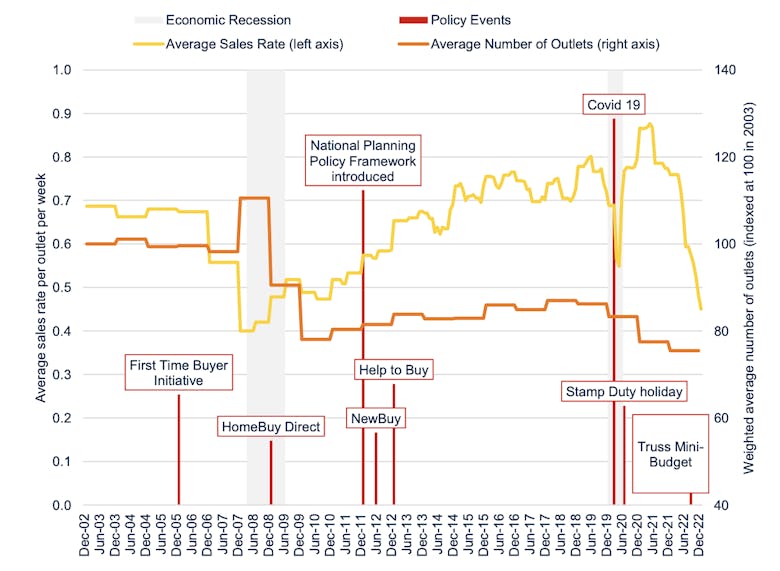

Housebuilding’s ‘new normal’ in nine charts

Savills has taken a deep dive into the mechanics and economic realities of the UK's housebuilding sector, highlighting some dramatic changes in the new-build sales landscape...

Government plans short-term rental database & more powers for landlords

New Renters Reform Bill measures announced as part of crackdown on anti-social behaviour.

Westminster Council ‘ready to lead’ on short-term rental regulation

'Short-term lets have been widely abused - when you have one residential block renting out more rooms than the Ritz every night, you know the system needs reform,' says the leader of Westminster City Council.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, Foxtons, Savills, Knight Frank, HMRC, OnTheMarket, Propertymark & more...

Tom Bill: What does the higher bank rate mean for the UK housing market?

Lenders are tinkering with mortgage rates as a contradictory set of events unfold but higher rates are here to stay, says Knight Frank's head of resi research.

Consultation launched on new Infrastructure Levy to replace S106

Proposals suggest a ten-year 'test and learn' period, with the new property development tax being rolled out in a few local areas first.

Tom Bill on what Hunt’s Budget means for the UK housing market

The economic backdrop has improved, but things could turn more political this year, says Knight Frank's UK resi research boss...

11 key takeaways: The Budget 2023 for HNWIs & business owners

Required Reading: Mishcon de Reya provides an essential briefing on the key announcements in yesterday's Budget statement, highlighting 11 need-to-know policy and tax changes...

‘We wanted to see more’ Vs. ‘Thank goodness the Chancellor decided to leave the property market well alone’: Housing industry reactions to the 2023 Spring Budget

A 'missed opportunity' or is 'no action the best stance'? Here's what the property industry makes of Jeremy Hunt's latest round fiscal policy updates...

Budget 2023: Chancellor keeps hands off the housing sector

Property was largely absent from Jeremy Hunt's Spring Budget statement.