Policy

Historic Highgate mansion ‘sells for £20m’

One of north London's most important period properties has reportedly changed hands for £20m.

RBKC to publish planners’ advice

Kensington & Chelsea Council is to start publishing the pre-application advice given by its planning officers.

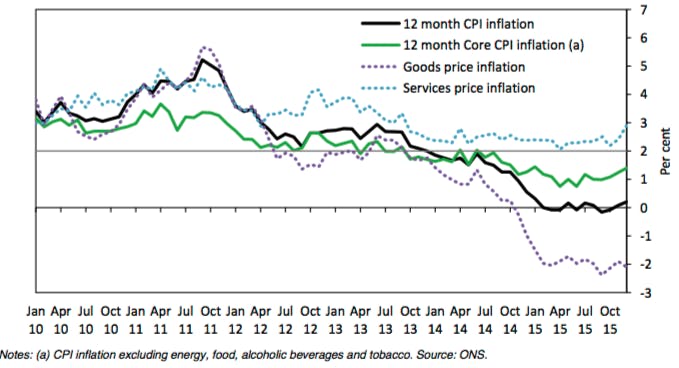

‘Now is not yet the time to raise interest rates’ – Carney

Bank of England Governor Mark Carney has ruled out an imminent interest rate rise.

Paper Fail: ‘If tax doesn’t kill the market, red tape will’

"If tax doesn't kill the market, red tape will," growls Alan Page, as a deal becomes mired in an absurd paperwork swamp.

Waiting Game: April ‘will be a good month to be negotiating’

Buy-to-live purchasers can't be blamed for sitting it out at the moment, says buying agent Sara Ransom, but there should be some decent discounts on the table come the Spring...

BoJo backs British Land’s Norton Folgate scheme

A controversial plan to redevelop a swathe of historic Spitalfields warehouses has been given the go-ahead by Mayor BoJo after a long-running battle.

The Long Game: Why London’s prime property market is under no real threat

London’s luxury housing market may be having a tough time getting used to recent government shake-ups, but traditional investors will eventually return, says David Willis...

Scotland’s buy-to-let levy ‘needs urgent clarification’

There's "a complete lack of real detail" on Scotland's amendment to LBTT, which will see a 3% surcharge for second homes and buy-to-let properties in line with changes to SDLT in England & Wales announced…

Third London borough to clamp down on mega-basements

Islington is on the verge of following Westminster and RBKC in toughening up its planning rules to deal with a surge in subterranean development.

Dispute Revolution: Are boundaries there to be pushed?

There is a little-known Bill currently going through the motions in Parliament that could have a big impact on the way high-end resi developers deal with neighbourly issues.

Complex SDLT consultation ‘will create anomalies and uncertainty’

HMRC's current consultation on higher rates of Stamp Duty will create anomalies and uncertainty, according to some top tax accountants, despite official efforts at a rudimentary flow diagram...

Planning application competition ‘could relieve burden on cash-strapped local authorities’

An amendment in the Housing and Planning Bill that could see external parties taking some of the planning strain away from under-resourced councils is a "step in the right direction", according to the…