The Market

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from the RICS, HMRC, Knight Frank, Adam Smith Institute & more...

‘Britain is being turned into the departure lounge’ warns non-dom lobby group

'The government is listening,' say lobbyists calling for a rethink on the abolition of non-dom status.

‘We are seeing a significant increase in enquiries from buyers considering relocating to Monaco’ – Knight Frank

Residential sales activity dipped in the super-rich Principality last year, but major property developments are literally changing the face of the Riviera enclave.

HNWIs ‘are deeply concerned’ about this month’s Budget event, warns top estate agency boss

Winkworth's Dominic Agace wants the Chancellor to 'avoid intervening in the UK economy' on 30th October.

Alex Michelin: Why London’s super-prime buyers are no longer driven by location

The significance of postcodes is fading, explains the influential luxury property developer, while demand for unique, individualised homes is rising.

House prices are climbing fastest in historic towns & commuter hotspots

While new towns have seen little-to-no house price growth in the last year.

Chancellor weighs CGT hike up to 39%

Treasury models seen by The Guardian suggest hiking Capital Gains Tax that much would be 'detrimental' to the national finances.

The Long View: Understanding the impact of changing demographics on prime UK housing markets

Buying agency Middleton Advisors investigates how key trends and structural changes could influence the sector over the next 30 years.

UK house prices return to growth for the first time in two years

The latest RICS survey results 'once again convey a brighter picture for housing market activity.'

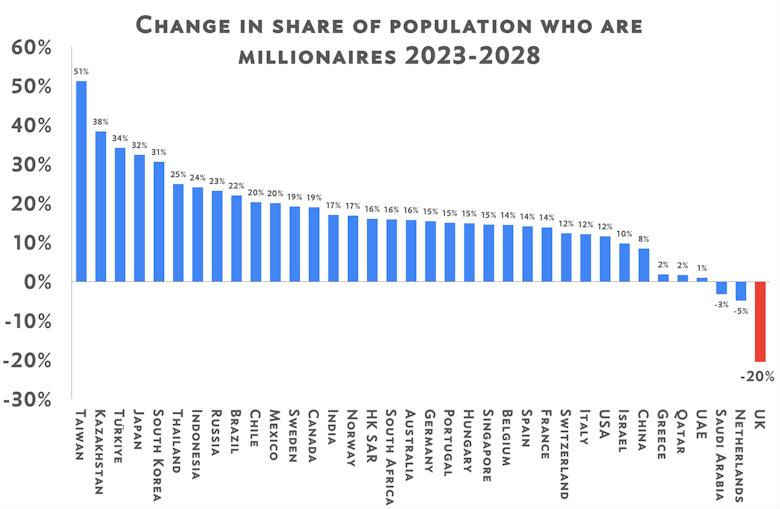

UK is ‘worst in the world for millionaire exits’, warn economists

The Adam Smith Institute believes the share of the UK population who are US dollar millionaires will fall by a fifth over the next four years, thanks to 'a hostile culture for wealth creators'.

Prime London rental growth back to ‘historically normal levels’

Annual change of 1.1% was recorded in PCL in September, the first time the figure has been below 2% since mid-2021.

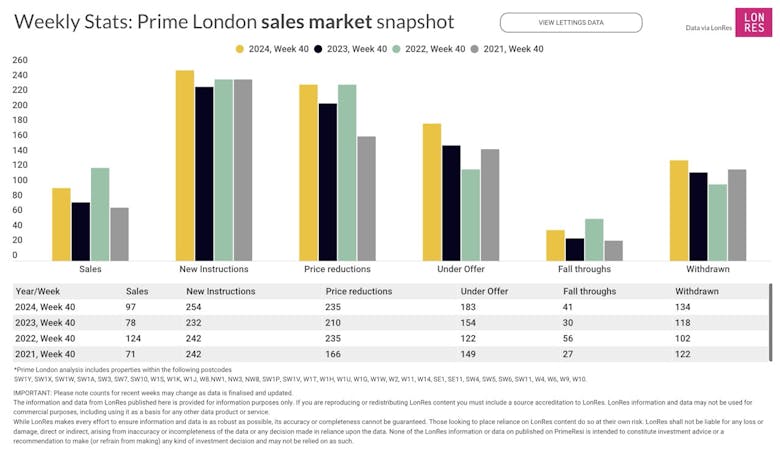

Prime London Property Market Snapshot: Week 40, 2024

Fresh LonRes data show sales market activity is up on last year, while lettings is down.