The Market

Letter from the West Country: Where to buy in 2015

The Buying Solution's West Country expert Ed Clarkson takes us on a whistle-stop tour of his patch and tips us off on where to find some serious value for money before everyone else cottons on...

Strutts revises PCL forecast down to zero but ‘pleasantly surprised’ at regional activity levels

Strutt & Parker may have quietly revised its 2015 PCL price forecast down from 2% to a big fat zero, but it's "pleasantly surprised" at the levels of activity going on the regions, especially given the looming…

Berkeley’s Ebury Square scheme rakes in £355m in just four months

Just sixteen weeks after launch, Berkeley Group's super-prime development in Belgravia has all but sold out, generating a whopping £355m for the firm.

Transactions climb but stay short of 2007’s peak (in most places)

The number of homes sold in the first ten months of 2014 was 21% higher than during the same period in 2013 and a solid 60% up on 2009's low-point, but was still 27% below 2007's boom-time.

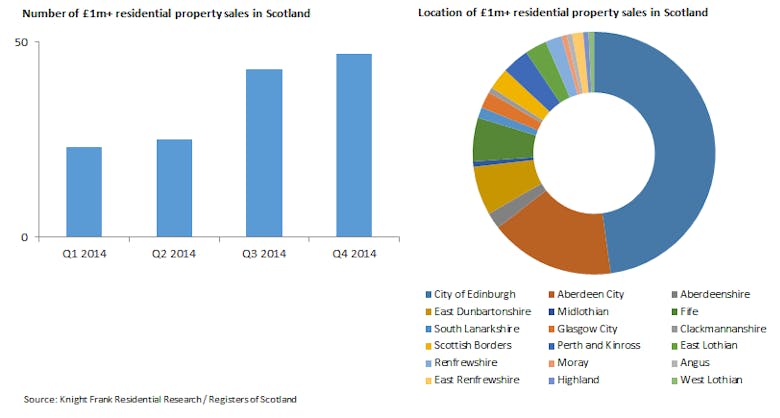

‘Sharp jump’ for Scotland’s £1m+ market

The number of seven-figure deals in Scotland climbed by 9% in the last quarter of the year, reports Knight Frank.

Notting Hill mews teams up for mass roof extension

What's thought to be London's biggest ever joint extension scheme is currently being weighed up by planners in west London.

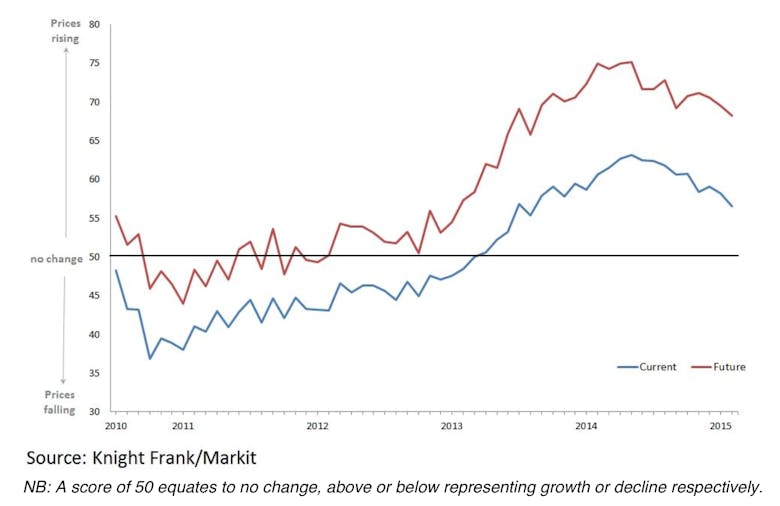

House price expectations drop to 18 month low – Knight Frank

We're "in for a steadier year than 2013 or 2014" this year, says Knight Frank, although "overall house price sentiment remains at an elevated level by historical standards."

Housebuilding jumps by 10%

The number of new homes being built across the country has risen to its highest tally since 2007, according to the latest government stats.

137,010 new homes were started in 2014;

Regions outperform as growth spreads beyond the Home Counties

Four bedroomed houses in Dorset were the ones to beat in terms of asking price growth in 2014, according to new research out today.

Is deflation good for the property market?

Whilst deflation shrinks the value of the equity in a property, the debt rises commensurately and that is not good for the "feel good factor", says Trevor Abrahmsohn...

Kensington & Chelsea publishes new basement planning guidance

Nearly a month after adopting a new policy designed to clamp down on subterranean development, the Royal Borough has released detailed guidance and advice for developers and homeowners applying for permission…

Planning nod for Landmark in Hampshire

Landmark Estates has been given the green light to redevelop a historic former hospital in Hampshire.