The Market

‘The volume of sales for properties over £1.5m has reached a plateau’

The volume in sales for properties over £1.5m looks set to fall for the first time in two years, according to 44-branch estate agency Jackson-Stops & Staff, despite year-on-year growth 36% from 2012-2014.

Shelling Out: PM pledges action on ‘dirty money’ in UK’s luxury property market

David Cameron has announced a crackdown on the purchase of UK properties via "anonymous shell companies".

1.1% monthly rise pushes house prices over 2007 peak

A 1.1% increase between May and June gives an annual price increase of 5.

Westminster moves to halt mega-basement ‘epidemic’

Just a few months after RBKC claimed victory in its long-running war on mega-basements, Westminster has announced plans to tackle a so-called “underground epidemic” across central London.

Buyers and sellers face removals headache in summer rush

A top end removals company has predicted some serious supply and demand issues over the coming weeks, as buyers scramble to get settled in time for the new school term.

Tide turns in UK’s waterfront market as average premium surges to 70%

A prime waterfront property is now worth an average of 70% more than a similar property inland, according to new analysis of homes along the UK's waterways and coastlines.

Historic Cheyne Walk mansion sells for £1m over asking

It sounds like Cheyne Walk is about to get yet another famous resident, in the shape of the former mayor of New York, Michael Bloomberg.

Southern Grove lines up £70m west London scheme

Southern Grove and Topland Group have bought up a sizeable retail block in Ealing with designs on a £70m resi-led scheme.

New Kensington Lettings Manager for Harrods Estates

Harrods Estates has hired Sam Wright to head up the lettings department of its new office on Kensington Church Street.

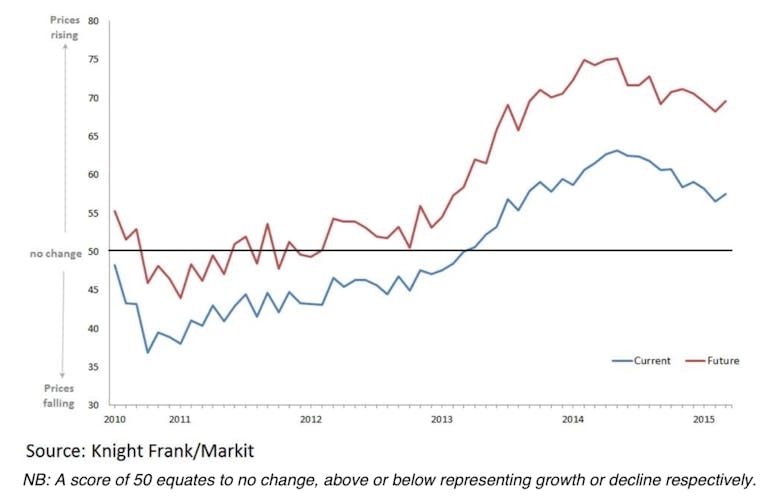

Homeowner sentiment stays positive for 28th consecutive month

Knight Frank's House Price Sentiment Index has stayed in positive territory for the 28th month a row, with households in all UK regions thinking that property prices rose in July.

Slump Duty: PCL transactions down by nearly a quarter so far this year

The "profound" effects of Osborne’s SDLT reforms on the PCL market are only just becoming clear, according to one of the capital's biggest estate agencies.

‘Scotland is the real winner’ as northern rises trump southern price performance

Zoopla's average property price across Britain increased by 2.