The Market

Record revenues for Engel & Völkers as European expansion plans take shape

Multinational agency Engel & Völkers has reported a chunky rise in revenues.

2015's group commission revenues were up 36.4% on 2014's totals and hit 409.8 million euros, a new record for the firm.

Behind the Numbers: Mortgage lending is actually still 46% down on pre-crash levels

Last week's Council of Mortgage Lenders numbers (reported here) show that gross mortgage lending for the UK is, overall, on the rise.

£5m+ deals tank by over 50% in London

Transaction volumes and average values took another tumble in London last quarter, particularly - and predictably - in the upper echelons.

Chelsea police station sale sets up £150m luxury resi scheme

23,153 square foot building sits on a 0.195 acre plot at the southern end of Lucan Place

All the property in the world is worth $217 trillion – Savills

"The entire developed property universe" is worth roughly US$217tr, with residential real estate accounting for the lion's share, according to some sums by Savills; that's around 2.

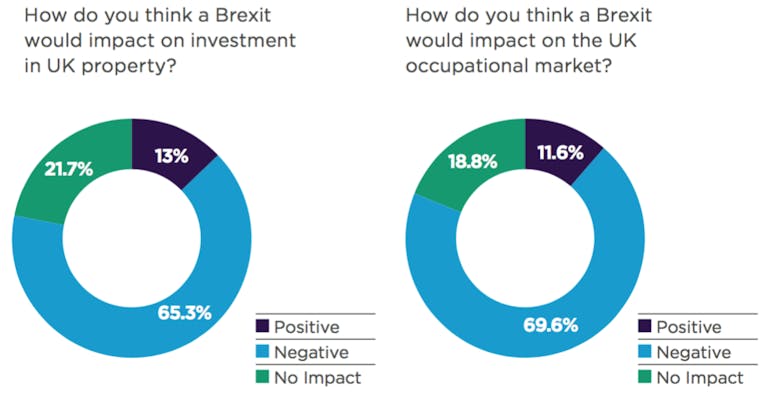

Brexit Wounds: What an EU Referendum means for the UK property industry

A British exit from the European Union poses a significant threat to the UK's property industry - and particularly the high-value residential sector - says Carter Jonas, after discovering that 65% of…

Hostile Makeover: Can these 12 items help sell a property faster?

Rooted in (where else but) California, the concept of "home staging" as a standalone discipline has been around since the early 1990s.

Is Strutts eyeing an expansion?

Strutt & Parker is reportedly looking to expand its estate agency business in the UK.

Prime Hampstead ‘design & build’ plots ask £7m

An unusual proposition has come up on one of Hampstead's best turnings.

Two adjacent plots are being offered on Redington Road, each with full planning permission for a chunky family residence.

At-A-Glance: 2015 Milestones

Three weeks in to 2016 and it feels a bit like we've just unstrapped ourselves from a bizarre property-themed rollercoaster.

Historic Highgate mansion ‘sells for £20m’

One of north London's most important period properties has reportedly changed hands for £20m.

Buying Guide: The Victorian Property

Combining period features with timeless layouts and high build quality, Victorian houses are as sought-after as ever, says Strutt & Parker's Barclay Macfarlane.