The Market

Prime Recce: Potential gains in Westminster, Victoria & Pimlico

Surveying prices and pipelines in 'the next sought-after prime areas of London'

Letting fees consultation earmarked for this Spring

Consultation to start sometime in March or April

Record month for UK’s auction market

December saw the highest ever number of lots offered and sold during the last month of the year, beating the previous highs recorded in 2007

Senior hire for Jackson-Stops in Devon

Head of Savills Exeter rejoins Jackson-Stops after 25 years

Total UK housing value jumped by nearly £500bn in 2016, but the landscape is shifting

The UK's £6.8tr housing stock is now worth 3.65 times Britain's GDP, says Savills

Things start moving again in London’s ‘besieged’ rental market

"We don't want to be too optimistic just yet... but nothing could be as bad as 2016"

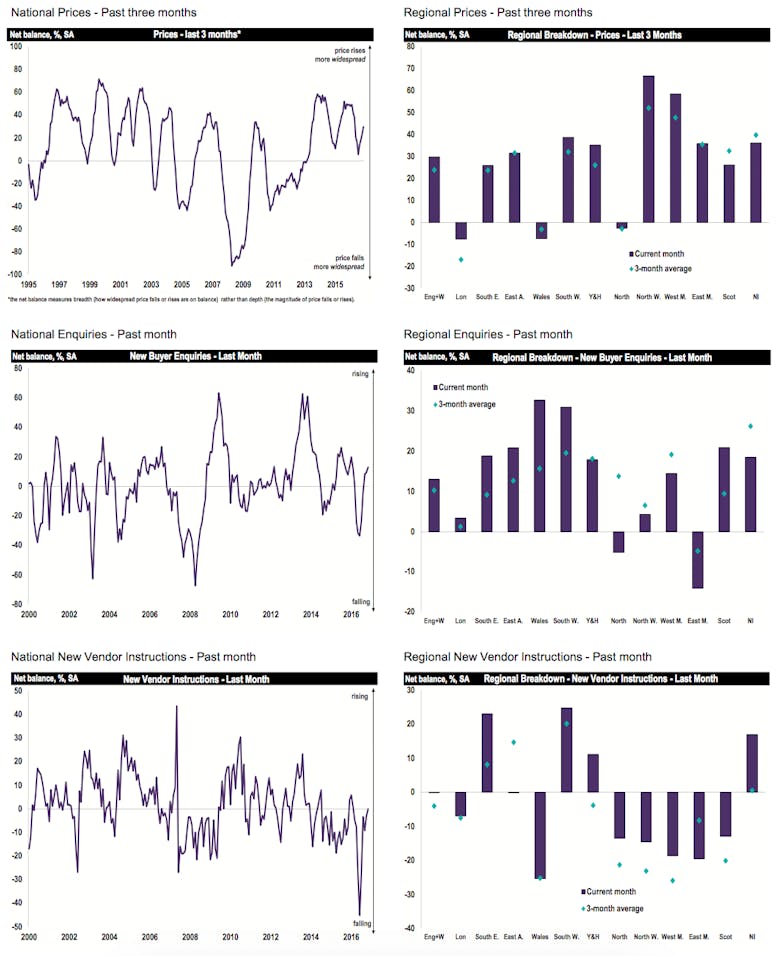

Market ‘stutters’ as sales activity dips – RICS

Deal numbers falter and surveyors' exceptions pare back

Why European elections are a boost for London’s property market

The capital's property market is set for growth as continental elections loom large, says a top PCL agent

How a buying agent moves to the country

Emma Seaton of Prime Purchase on trading Wandsworth for Hampshire

10,500 UK car parks ‘have resi potential’

'There is a growing body of evidence that city centre car parks can be used as housing development sites'

Prime rental stock surges in the Home Counties

Instructions and appraisals soar while average rents dip

Notes on overseas buyer trends in London

'We've seen a flurry of Italian interest in Earl's Court'