The Market

Mapped: Comparing values & performance across Prime Central London

From Bayswater to Westminster, this is how London’s top neighbourhoods are stacking up in 2025.

Rumourmill: Reeves mulls new property levy to replace stamp duty

Treasury said to be weighing charge on £500k+ homes, with council tax overhaul also on the table.

Monday Market Review: Key figures & findings from the last seven days

Your essential five-minute briefing on the latest market movements & commentary, featuring data and analysis from CBRE, Hamptons, Knight Frank, Altrata, Acadata, RICS, Foxtons & more ...

Rightmove reports ‘best July for sales agreed since 2020’ as prices fall

'Savvy summer sellers price competitively to stand out & attract a buyer,' says property portal as asking prices drop, price cuts proliferate, and deal numbers rise.

Ranked: ‘Best value’ London commuter towns for prime buyers in 2025

Analysis by Savills suggests those prepared to commute 60-90 minutes into the capital save an average of 55% on housing & transport costs.

HNWIs ‘would be prepared to pay a premium for staying in the UK’

'It's absolutely true that those with the broadest shoulders should bear the greatest burden,' says lobbyist Leslie McLeod-Miller of Foreign Investors for Britain.

Development land values fall as ‘conditions worsen’ for housebuilders

Planning delays and buyer sentiment are the biggest challenges facing property developers, says Knight Frank.

Wildlife rules under review as Treasury looks to boost building

Rachel Reeves said to weigh curbs on ‘bats and newts’ rules in push to speed up development.

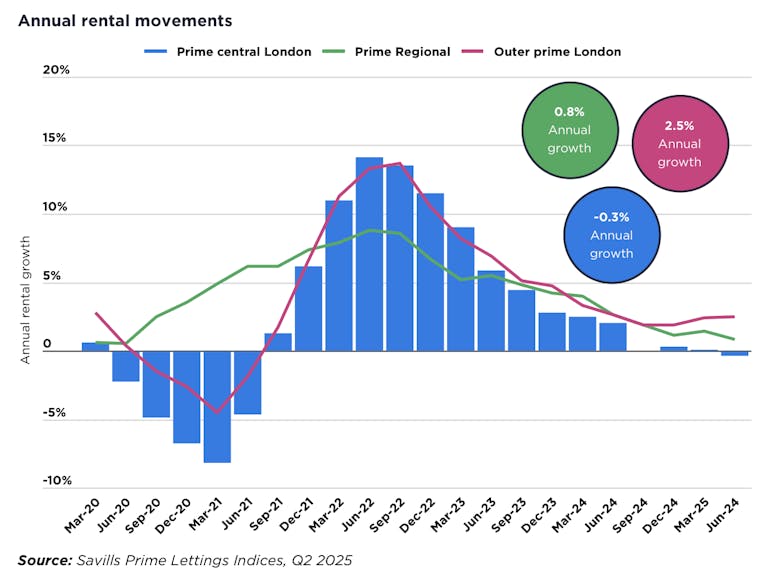

‘Fierce competition’ in SW London sees renters bid above asking

'75% of family houses were let at the asking price or above on the first viewing' in July, reports Savills.

Non-dom flight ‘in-line with, or even below’ OBR forecasts

HMRC data suggest the official prediction of how many non-doms would leave the UK when the tax break was scrapped is on the money.

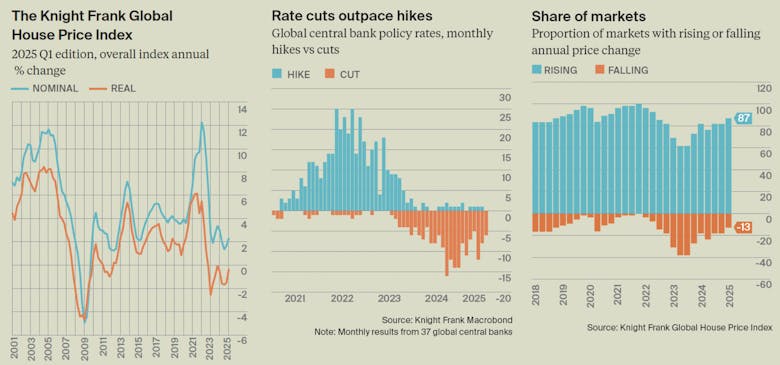

Global house prices tick up but ‘further growth hinges on rate cuts’

87% of international markets tracked by Knight Frank have seen residential values increase in the last year.

Foxtons reports jump in new homes sales

Major London agency sold 16.5% more new-build homes in the first half of 2025 than in the same period last year.