The Market

‘Next year will see super-prime return with a bang’ & other property market predictions from a top buying agent

Edward Heaton, founder and managing partner of buying agency Heaton & Partners, shares his top property market predictions for the year ahead.

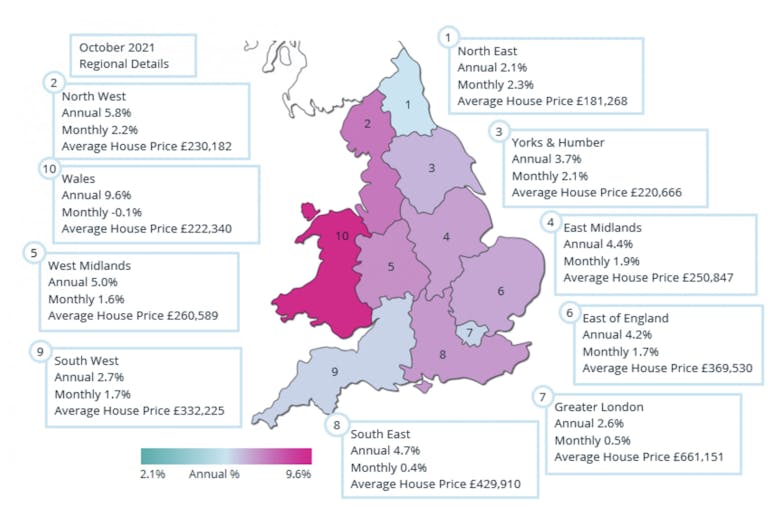

House prices are still growing across England & Wales, albeit slower

Wales has been at the top of the annual price growth league for five months now, reports Acadata

Entire home Airbnb listings in London have increased by 571% in 5 years: new research

Governments planning on introducing significant rental reforms need to ensure that further properties are not lost from the residential sector, writes Tom Simcock

Capital Gains Tax should be extended to nearly all homes, argues top think tank; here’s how it could work

Home-owners have benefitted from an "unearned, unequal and untaxed £3 trillion capital gains windfall" over the last 20 years, says the Resolution Foundation;

London market regains ground as buyers return from the country

The capital’s share of sales agreed above £1m has reached it highest level since April 2020, reports Savills

Property sales falter as supply drought continues – RICS

“Unless this trend is reversed soon, transaction levels may flatline in 2022 with limited choice proving more significant than any shift in the interest rate environment for new buyers," warns the Royal…

Lodha UK celebrates ‘extraordinary’ £310m super-prime sales spree on Grosvenor Square

Over £310 million-worth of apartments were sold in just seven weeks at Lodha UK's flagship development in Mayfair - at an average price of over £24m.

Pandemic property boom ‘may have peaked in some parts of the world’ – Knight Frank

Half of the locations tracked by Knight Frank's Global House Price Index have seen double-digit property price inflation in the last year - but growth rates in some of the punchiest world markets now…

‘Balance will be restored’: Key trends for international luxury property markets in 2022

“After a record-breaking year in luxury real estate, we anticipate that some balance will be restored to the market,” says Luxury Portfolio International after surveying nearly 5,000 affluent consumers.

Martin Bikhit: International buyers are set to take London’s housing market by storm

The capital’s housing market has the potential to explode come the start of 2022, says the BHHS London MD…

Country home renaissance to continue in 2022, predicts Jackson-Stops

National estate agency predicts 3% growth for average UK property prices, with prime country houses set to out-perform at +5%.

PCL flats ‘starting to look like really good value’, says buying agency

Apartment values in some key London postcodes have now fallen below 2014 levels, but is the tide on the turn once more?