The Market

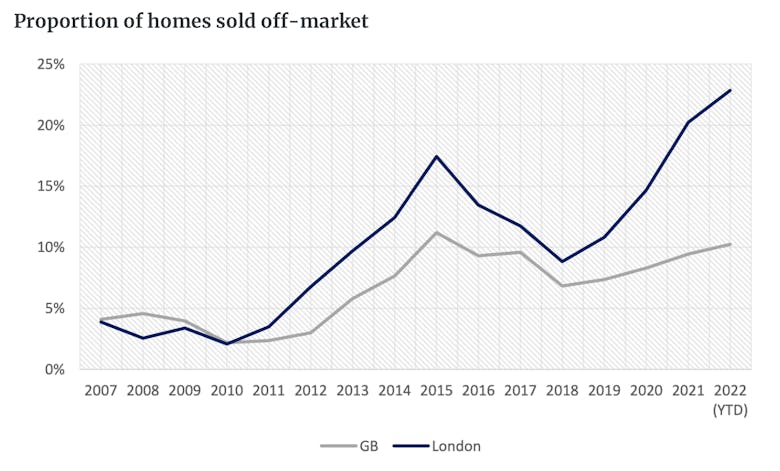

The Sunday Times: Why one in ten properties are sold in secret

"Frenzied demand from buyers and a shortage of properties for sale have led to a boom in off-market sales, where homes are sold without being listed on an estate agent’s website or a property portal,"…

Johnson orders comprehensive mortgage market review to boost first-time buyers

Housebuilding target abandoned as the Prime Minister launches an independent review of access to mortgage finance. Property industry calls out proposals as "bluff and bluster".

Estate agents report drop in buyer demand, but house prices continue to climb – RICS

Property prices may prove "resilient" in the face of rising interest rates and costs of living, but transaction numbers are "likely to slow as the year wears on," warn surveyors.

Asking price to sold price gap shrinks

Average asking prices are rising at a slower pace than achieved sold prices, according to some analysis by London estate agency Benham and Reeves.

‘The dynamism of cities is reasserting itself’: Global city house prices out-perform national averages

House price growth in global cities is outpacing national averages, according to Knight Frank's latest indices - but signs point to a general property market slowdown.

Buyers digging deeper for super-sized homes

LonRes reports on Prime London's palatial price premiums

High-end sales still surging in Prime London

LonRes records spike in under-offer numbers as prices breach pre-pandemic levels

‘Concerns over the property market are overstated’ – Fine & Country boss

"The wealthier you are, the more confident you are," says a bullish Simon Leadbetter, Global CEO of Fine & Country.

Beleaguered Johnson promises ‘to kindle that dream of home ownership’

"Later this week – if I am here later this week and I very much hope that I will be – Michael Gove and I will be setting out plans to kindle that dream of home ownership in the hearts of millions who…

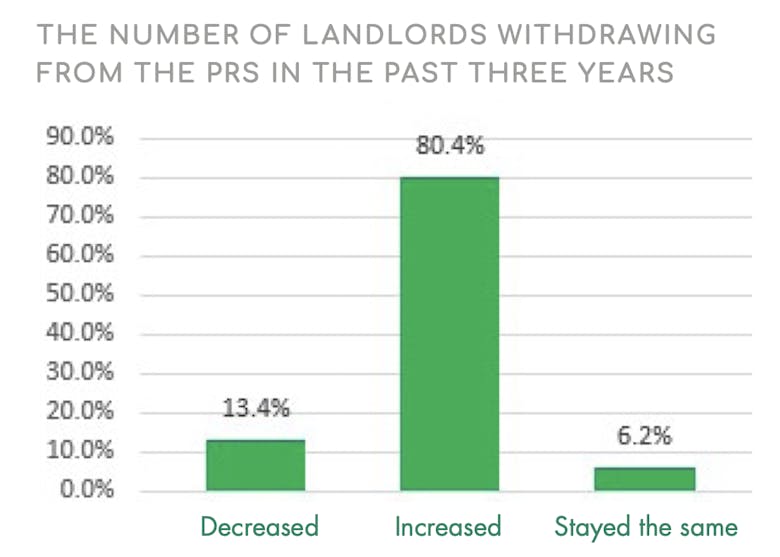

Private rental stock has dropped by half since 2019 as landlords exit the market

Estate agency branches had an average of 15.6 properties available to rent in March this year, says Propertymark, down from 30.4 in March 2019.

Off-market property sales soar as mainstream sellers embrace discreet marketing

One in ten homes sold across the UK so far in 2022 were only marketed quietly, rather than being openly broadcast on the portals. That figure rises to nearly a quarter in London and prime country markets.

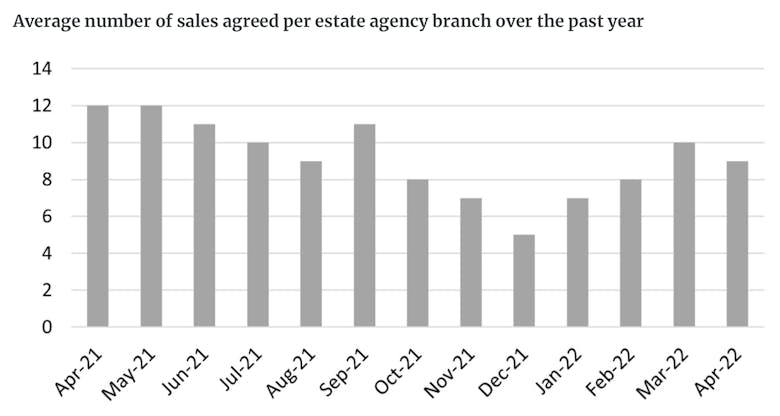

Deal numbers hold up despite low stock

Estate agents agreed an average of nine sales per branch in April, says Propertymark - roughly in line with the long-term average, despite a continued shortage of homes available to buy.