The Market

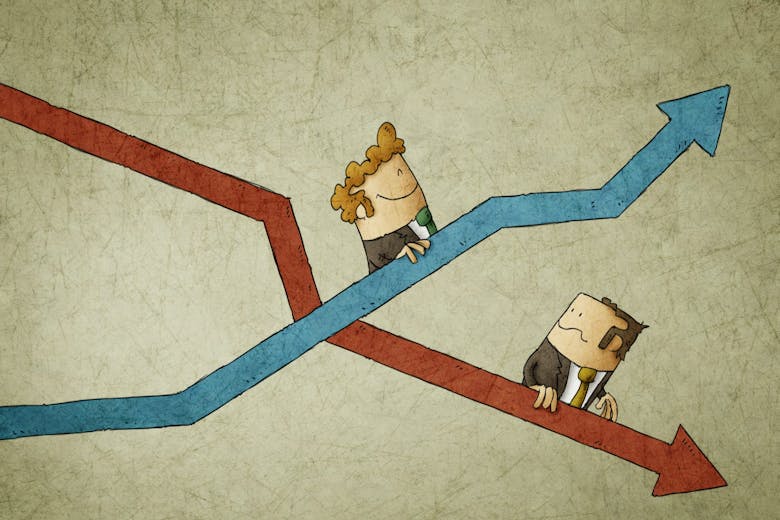

Six Years On: UK Vs EU house price growth since the Brexit vote

Average house prices across the EU-27 have increased by 39% since 2016, while the UK has seen 31% growth.

Bloomberg: The world’s bubbliest housing markets are flashing warning signs

Enda Curran examines the potential impact of a global housing market slowdown on the world’s economy in this Bloomberg deep-dive

House prices continued to climb in April – UK HPI

Official data - which comes with a time lag - tells of a continuing property market boom.

‘Remarkable buyer & seller confidence prevails’ – OnTheMarket

An inevitable rebalancing of supply and demand "will take time", says property portal. Until then, "the ‘new normal’, an elevated version of the pre-pandemic market continues."

BoE drops mortgage affordability test

"Removing the current stress testing could mitigate some of the impact of higher interest rates," suggests Savills, and is "not as reckless as it may sound".

Heatmapped: Resurgent PCL catching up with the rest of the capital

Latest analysis by LCP and Bricks & Logic shows effect of overseas demand beginning to return to London; is a narrowing of the price gap between apartments and houses around the corner?

Asking prices rise to another record high – but the pace of growth slows further

"There are likely to be some month-on-month price falls during the second half of the year," says Rightmove.

Rental growth hits double figures – but it’s becoming cheaper to rent than to buy as mortgage costs climb

Central London rents are bouncing back hard from pandemic depths, suggests Hamptons' latest letting index.

Monday Market Review: Key figures and findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from JLL, Capgemini, Acadata, Rightmove, Knight Frank & more…

Time for a revival? Why Knightsbridge is the PCL neighbourhood to watch

Knightsbridge has lagged behind its neighbours over the last couple of years, but the market is finally on the turn, reports Patrick Alvarado

Buying agency reports ‘a growing sense of caution amongst buyers and sellers alike’

Property market activity "has remained brisk" over the last month, says buying agency Garrington, although there's "a growing sense of caution amongst buyers and sellers alike, who have increasingly divided…

BoE bumps base rate up to 1.25%

Britain's central bank hikes interest rates again in a bid to curb inflation.