The Market

Prime London flat prices jump 11.8% as the capital shows ‘a slow but steady return to health’

New analysis of LonRes data confirms that the pandemic-drive 'race for space' is over in the London, with demand for apartments now significantly outpacing that for houses.

Home-buyer & seller sentiment ‘remains robust’, says portal

'There’s evidence that buyers feel the market is moving in their favour,' says OnTheMarket boss Jason Tebb, as the portal reveals results of its September Sentiment Survey - conducted before the now-unravelled…

Lucian Cook on the role of debt in the prime resi market

Savills research chief looks at the implications of increases in the cost of living and mortgage finance for the prime housing market.

Revealed: The UK areas with the highest percentage of cash buyers

The proportion of cash buyers ranges from less than 20% in Barking & Dagenham to nearly 60% in parts of Norfolk, new research shows.

Property industry reactions to tax u-turns & another new Chancellor

Thoughts from Savills, Knight Frank Finance, Fine & Country, Benham and Reeves, Anderson Harris, and Propertymark.

New Chancellor Hunt reverses most Truss tax cuts

Former Health Secretary Jeremy Hunt has torn down most of Kwarsi Kwarteng's three-week-old tax cuts - but the Stamp Duty cut remains.

Asking prices continue to climb as some buyers pause while others rush deals through

'The vast majority of buyers who had already agreed their purchase are still going ahead,' says Rightmove, but some buyers 'have had their plans dashed by the sudden nature of the mortgage rate rises.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from UBS, Rightmove, Knight Frank, Savills, Acadata & more…

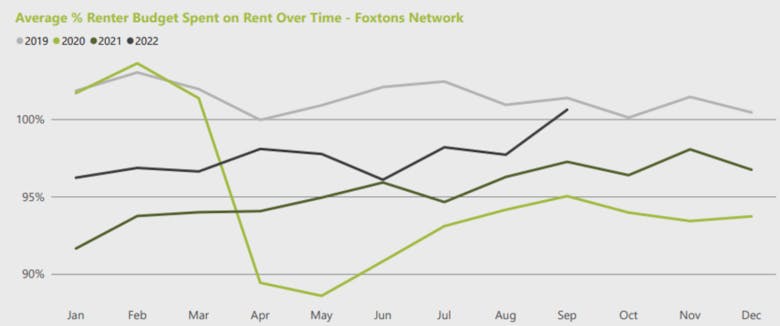

London rents reach a record high as supply shrinks and demand climbs

Foxtons has listed 38% fewer rental properties so far this year compared to last, while tenant demand is running high.

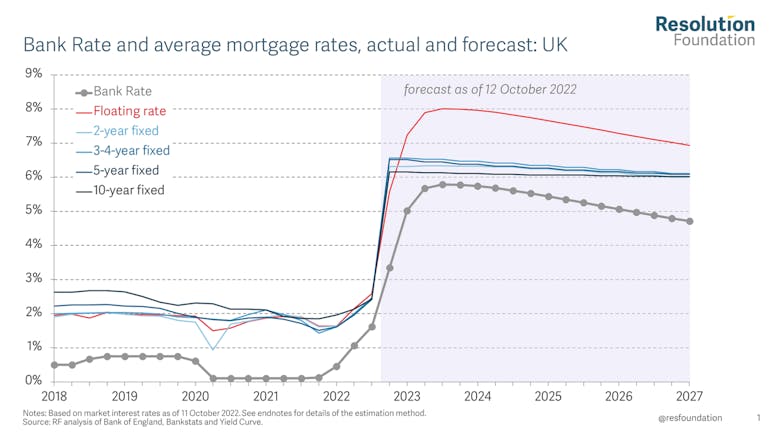

The potential impact of rising interest rates in seven graphs

The Resolution Foundation estimates the average London mortgagor will be paying £5,500 more in annual costs by the end of 2024.

Truss sacks Kwarteng as Chancellor; rolls back another tax cut

Jeremy Hunt has replaced Kwasi Kwarteng as Chancellor of the Exchequer.

Global housing markets are ‘at the tipping point’, warns UBS, with ‘significant price corrections’ imminent in many world cities

'We are witnessing the owner-occupied housing boom finally under pressure globally,' says UBS, which warns of 'significant price corrections' in a majority of the highly-valued global cities in the coming…