The Market

‘It’s clear that London is being driven by the £1mn+ market at present’

There are 19,116 properties currently listed for sale across London for at least £1mn - representing 19% of total market stock.

Prime property market paralysis: On navigating the buyer-seller standoff

Right now we appear to have an impasse, with buyers trying to time the market and sellers too nervous to test it - but how long are both sides prepared to wait?

House prices to continue falling through 2024, predicts Lloyds

Average property values will be 7% lower at the end of 2024 than at the start of 2023, says major mortgage lender.

London’s property market has ‘turned a corner’, says Foxtons

Estate agency expects the market 'to finish on a positive note by the end of the year'.

Nearly 50% of our current buyers are purchasing buy-to-lets within PCL – LCP

Buoyant market conditions are making rental investments look 'very attractive' to opportunists, reports firm.

Beyond luxury hotels: Global branded resi boom continues as more brands diversify

More than 690 branded residential schemes have completed globally so far, says Savills, and another 600 are expected to be delivered by 2030.

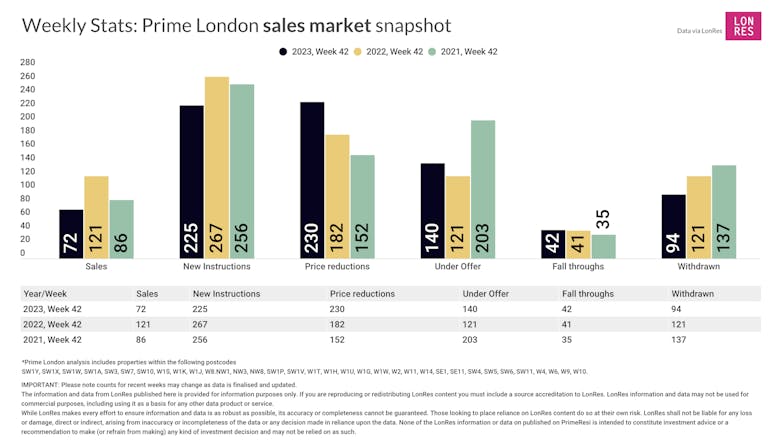

Prime London Property Market Snapshot: Week 42, 2023

41% fewer property sales were agreed in prime London last week compared to the same week in 2022, according to the latest PrimeResi Data Hub update.

‘The vast majority of properties are selling below the asking price’ – Propertymark

September data from estate agents 'points to a pricing correction despite average house prices continuing to rise'.

From turnkey one-beds to carbon zero family homes: Prime market trends to watch, according to a top buying agent

'Developers take heed, you will do well focusing on luxury developments for the one-bed singleton market,' advises Jazmin Atkins

The property market’s ability to adapt & evolve is what’s keeping the wheels moving – TwentyCi

Exchanges are running -20% below last year's levels, but there is still a 'substantial and solid core of activity'.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, ONS, Savills, Benham & Reeves, Acadata, CBRE & more...

Tories float ‘stamp duty cut to win over voters’

Cutting Stamp Duty 'would cost a lot of money', admits a Conservative Party source, but could appeal to middle-aged voters.