The Market

Tories float September Stamp Duty cut

The Chancellor is considering raising the SDLT threshold to £300k, according to newspaper reports.

Top-end properties are driving the Spring sales market

Rightmove's 'top of the ladder' market segment - which tracks larger homes for sale - is seeing its strongest start to the year for price growth since 2014.

Rental growth stabilises in ‘subdued’ Prime London lettings market

Annual rental growth of 3.8% was up only slightly last month, while activity levels fell back after a good start to the year.

Savills auction boosted by hat-trick of Chelsea sales

Agency's latest live-streamed event raised £62mn amid strong demand for high-value lots.

Prime London’s top-end outperforms in ‘slow’ spring market

The £5mn-plus market has been the most active prime London sales sector since 2021, reports LonRes.

Edinburgh house prices return to positive growth

'Buyer sentiment is improving' in the Scottish capital, says Knight Frank, as £1mn+ homes lead on price growth.

Ranked: The most popular London leaver & relocation hotspots

More than 1 in 10 moves in the East and South East of England are made by incoming Londoners, reports Savills.

Industry Reactions: UK HPI suggests house prices steadying as inflation eases

The average UK house price in February was just 0.2% lower than in the same month last year. Our panel of estate agents, buying agents and mortgage brokers weigh-in on the latest official data.

Prime London Property Market Snapshot: Week 15, 2024

Fresh LonRes data point to a spike in prime London properties going under offer following the Easter break, coinciding with a sharp increase in price reductions and new instructions.

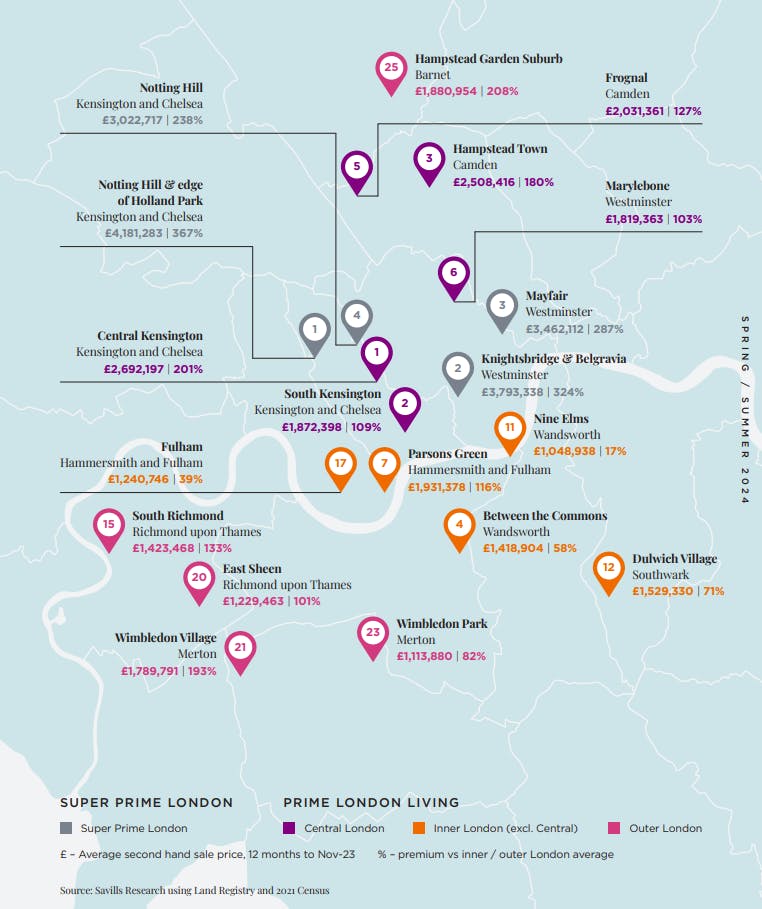

Revealed: London’s ‘most desirable neighbourhoods’

Savills has used socio-economic and health data from the Census alongside house price records to rank the capital's top enclaves for prime and super-prime property buyers.

Jennet Siebrits: Are homeowners right to feel brighter this year?

CBRE's research chief explains what the firm's latest consumer survey tells us about sentiment, spending and savings patterns & expectations for the year ahead.

Confidence slowly returning to the market – Acadata

Affordability pressures expected to ease but buyers 'cannot afford to throw caution to the wind'