The Market

Housebuilders back mandatory local housing targets as land values flatline

Prime Central London land pricing has "proven more resilient" than regional sites across England, says Knight Frank.

Top-end buyers downsize in London as Dubai, Miami & French Riviera woo world’s wealthiest

Competition from other wealth centres, concerns about a Labour government & taxation worries have led billionaires to spend less & buy smaller homes in PCL this year, reports Beauchamp Estates.

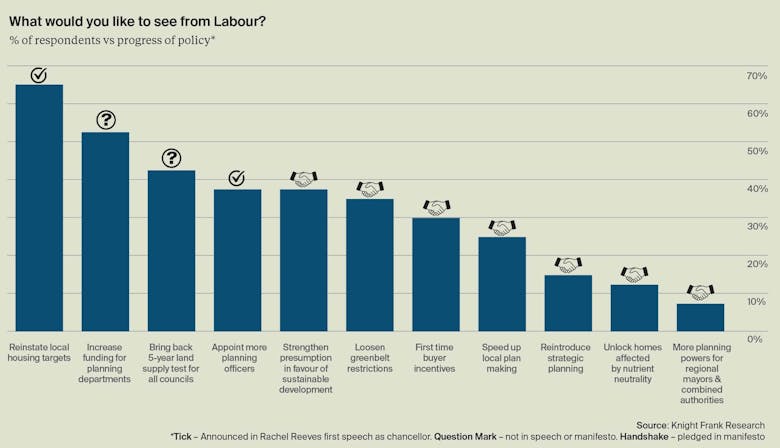

Labour’s First 100 Days: Prime resi leaders share their policy priorities for the new government

Property industry insiders reveal what they would do if they were in charge, from cracking on with planning reform and cutting Stamp Duty to clearing up the Building Safety Act.

Prime London rental market slows after strong start to the year

LonRes recorded an annual decrease of 2.5% in lets agreed and a 5.1% fall in new instructions last month - while rental growth slipped to 0.4%.

Political certainty & a potential interest rate drop ‘bode well for Autumn market’

Rightmove heralds rising transactions as house prices 'remain stable overall' - despite 'more diversions than normal at this time of year.'

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, Rightmove, Beauchamp Estates, Benham & Reeves, HMRC, Foxtons, Savills, Knight Frank…

Property industry bodies call on Rayner to regulate estate agents

An open letter from the RICS, PropertyMark, British Property Federation & more calls for the resurrection of RoPA legislation.

There is a sense that the summer slowdown has come a little early – LonRes

Latest Prime London data shows activity slowed in the lead-up to the General Election, while the annual rate of price growth dropped to -4.5%

Dwindling supply meets robust demand: Rupert des Forges on PCL’s luxury property squeeze

Those looking to secure a best-in-class new-build in the coming years will need to take an opportunistic yet strategic buying approach, writes Knight Frank's head of PCL developments.

HNW property developers & investors are ‘optimistic’ about UK real estate

We're 'past the eye of the storm', says Investec as property developers & investors display 'a clear sense of both growing optimism and activity levels.'

Prime buyer demand ‘creeps up’ in London

Almost one in five Rightmove listings priced between £2mn and £10mn had found a buyer in Q2.

‘A Dickensian legal process’: Why property deals take so long to complete

Propertymark data shows that, in March 2016, 78% of transactions progressed from offer acceptance to exchange of contracts within 12 weeks; in March 2024, the figure had slumped to just 29%.