Lettings

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Halifax, the OBR, LonRes, Knight Frank, Prime Purchase & more...

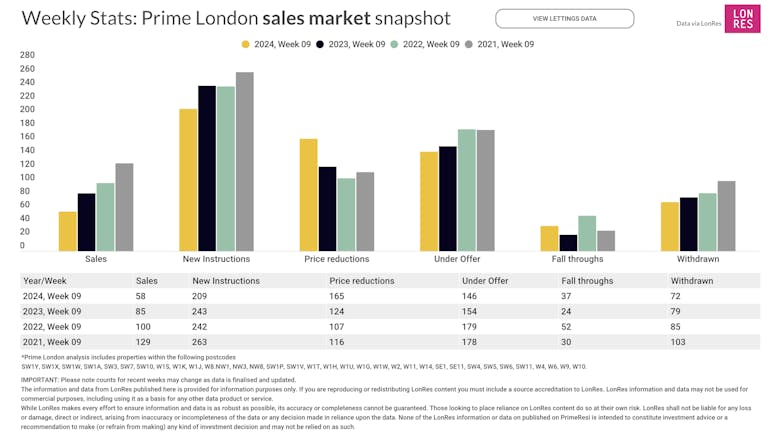

Prime London Property Market Snapshot: Week 09, 2024

Reports of a big deal surge at the top-end of the London property market bely a quiet picture across the capital's prime postcodes.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Nationwide, Knight Frank, Zoopla, the Bank of England, HMRC & more...

Prime London Property Market Snapshot: Week 08, 2024

13% fewer sales were recorded across prime London’s postcodes in the first two months of this year than in the same eight-week period last year.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Foxtons, Lloyds Bank, Benham & Reeves, Rightmove, Knight Frank, Rettie & more...

Prime London Property Market Snapshot: Week 07, 2024

It's still quiet out there, but deal numbers have picked up in prime London in the last week.

London agency reports 25% jump in new lettings instructions

Foxtons heralds 'a shift towards a more realistic lettings market, characterised by higher supply levels and less inflated demand.'

Airbnbs will require planning permission, confirms government

New legislation is in the works that will require owners to secure change of use consent for short-term rental properties in England.

Post-pandemic rental premium for houses still there

Rental growth for flats & houses in prime London has followed differing paths since early 2020.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, Investec, the ONS, Chesterton, Savills, Hamptons & more...

Pace of rental growth in London has halved since August

'Rental growth has passed its peak' across most of Great Britain, says Hamptons, as rents continue to climb.

Global luxury rental boom ‘is coming to a close’

Knight Frank's Prime Global Rental Index has recorded its first quarterly decline since Q1 2021.