Lettings

Rental stock deluge eases across PCL

New instructions down by 6% y-o-y; annual price movement now at -4.8%, compared to -5.2% in December 2016

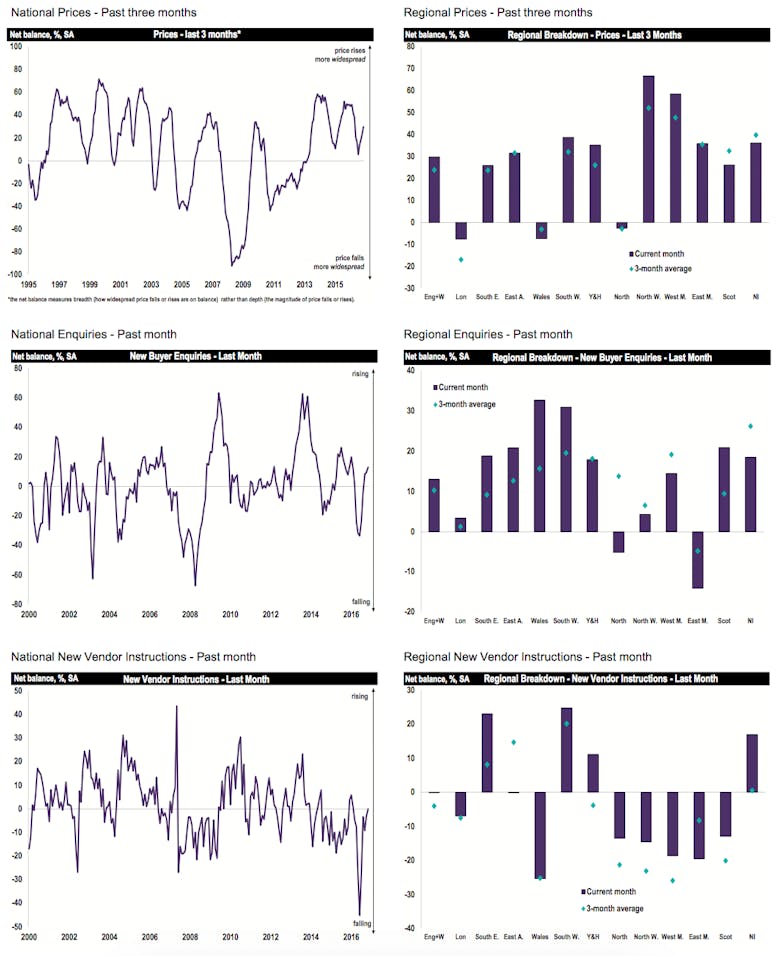

Property market activity pauses for the election – RICS

New buyer enquiries, new instructions and agreed sales all fall in May

Banning letting agent fees to tenants: Practical matters from the TPO

The Property Ombudsman responds to the government's consultation on banning letting agent fees paid by tenants

Surveying the shifting buy-to-let landscape

As a new tax regime looms for private buy-to-let investors, Shawbrook Bank looks at how the sector is evolving - and what challenges lie ahead for investors

7 Graphs: Price Reductions in Prime Central London

'Still some recorrection to come'

Nine Elms’ new-builds flood the lettings market

Prices slide across SE11, SW11 and SW8 as available listings soar by 28%

Tenant takes on £27,500 pw Mayfair super-let

One of the biggest lettings deals of 2017 so far

Only 12% of homes sold in London last month were bought by an investor

Proportion approaches record low as focus shifts to the regions

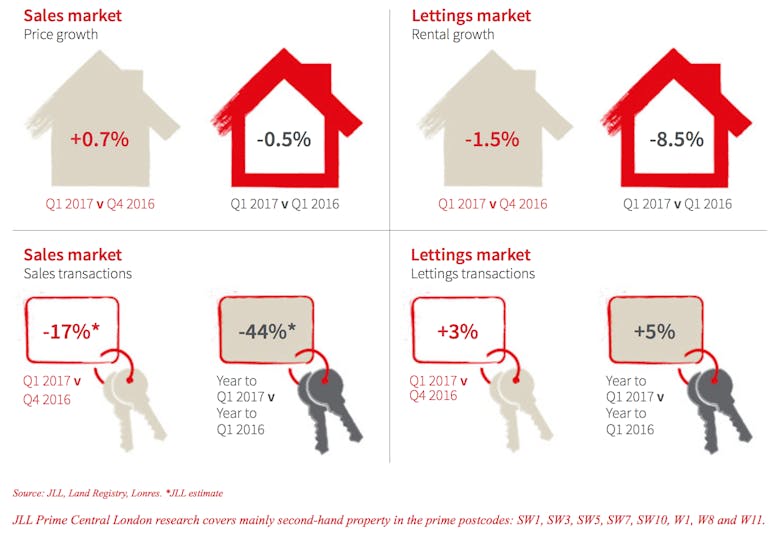

PCL rental values took another hit in Q1

Nearly half of properties reduced in price before letting in the first three months of the year...

PCL deal numbers are likely to pick up this quarter

"The evidence continues to point to improving demand and a bottoming out of price declines this year", says Knight Frank

Prime Central London prices turn up as optimism returns – JLL

Sale values rise for the first time since 2014

Prime rental deals surge in the Home Counties

Knight Frank records a 23% rise in the number of tenancies agreed in Q1, but values are still on the slide...