Economics

Bank of England nudges interest rates up to 0.75%

The BoE's Monetary Policy Committee has raised the base rate of interest by 0.25%, to the highest level since the start of the Covid-19 pandemic.

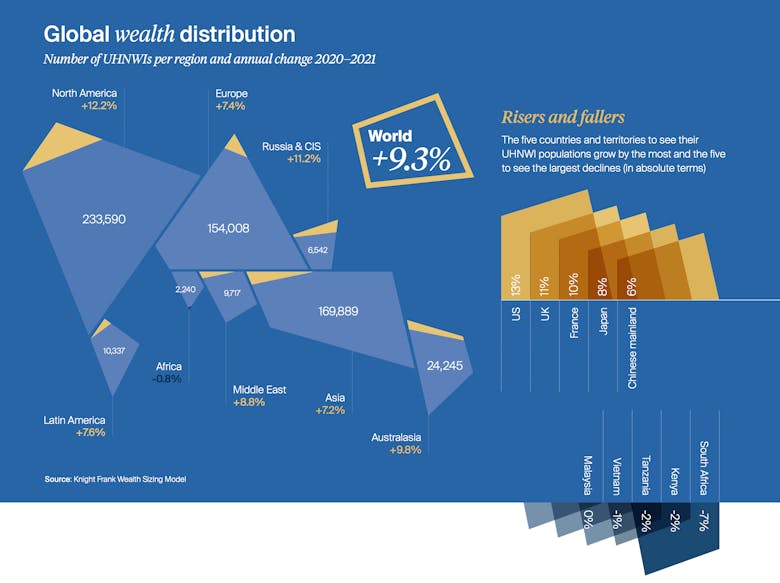

Wealth Creation in 2022: Liam Bailey’s 11 key insights

Knight Frank’s Global Head of Research, Liam Bailey, shares his key insights from the 16th edition of the firm's flagship annual publication, The Wealth Report.

UK’s CGT bills leap 20% to hit record £12.9bn

The sharp rise was partly driven by buy-to-let property investors cashing in on the fast-rising housing market

London’s Red Squares: Exploring the capital’s hotspots for HNW Russian property buyers

"An attraction of the UK as a whole for Russian buyers was that they felt their assets were safe here," says estate agency boss Mark Pollack.

Monday Market Review: 14th Feb 2022

PrimeResi's weekly summary of key property market stories and indices.

BoE raises interest rates, with more increases on the way

Bank of England projections anticipate that the base interest rate will rise to "around 1.5% by the middle of 2023".

UK housing value tops £8 trillion after record surge

2021's increase of £804 billion was the largest ever recorded, reports Savills

Global resi investment outstripped offices for the first time last year

Total investment volumes bounced back 'very strongly' in 2021, reports Savills, as more funds looked to get into real estate

Lucian Cook on house price forecasts: Deciphering the messages in 2022

Savills' head of residential research reflects on how forecasters translate actions and events into numbers and trends to come up with property market predictions for the year ahead.

Tom Bill: Four things to watch for the UK property market in 2022

Knight Frank's UK resi research boss runs through the key factors that could affect the trajectory of the market over the next 12 months...

UK Residential Property Market: 2021 in numbers

Knight Frank presents the 12 numbers of 2021...