Economics

Tapping the Top End: Lucian Cook on the potential impact of taxing luxury homes

As the Treasury signals tax changes, Savills' Head of Residential Research examines their potential impact on the prime property market.

Property & Pre-Budget Propaganda: Charles Curran on the real effects of policy leaks & speculation

Maskells' MD reflects on how the recent raft of terrifying predictions are impacting on activity in the prime market - and why opportunistic buyers are still pressing ahead.

Rumourmill: Chancellor ‘plotting mansion tax raid’ on £2mn+ homes

More speculation about potential tax hikes in November's Budget event.

Borough by Borough: Charting short supply & rising prices in London’s housing market

CBRE's annual Borough by Borough report reveals a tapestry of local performance alongside over-arching trends shaping the capital's residential market.

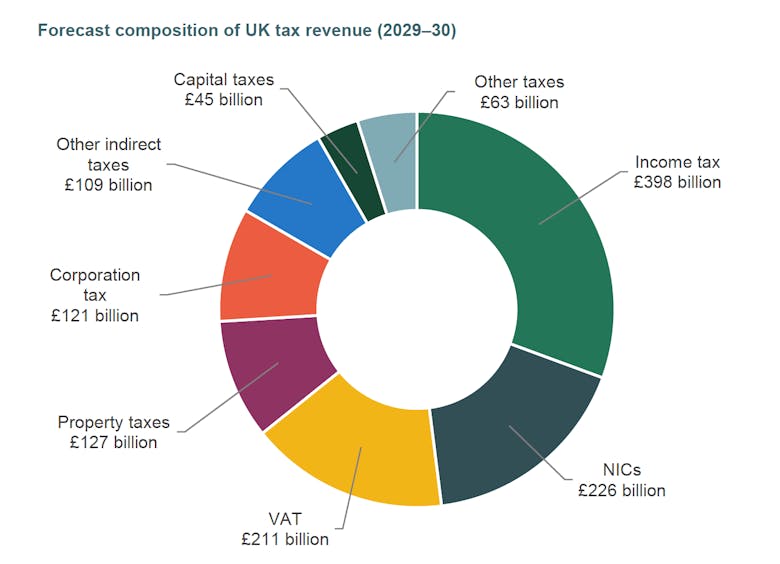

UK property tax regime is ‘second worst’ in the world

American think tank's analysis prompts fresh calls for the abolition of Stamp Duty.

Tom Bill: Lower borrowing costs offer respite for the Treasury & mortgage holders

Falling gilt yields may give the government more breathing room but possibly not enough to prevent new property taxes in next month’s Budget, explains Knight Frank's head of UK resi research.

Landmark flooding guidance outlines growing risks & responsibilities for property pros

The RICS has published a 'comprehensive overview' of flooding & its implications for property professionals at the same time as the government releases an 'action plan' to help protect more homes from…

No such thing as bad publicity: On navigating negativity, noise & nuance in Prime London’s property market

Beyond the algorithm-driven echo chambers, prime buyers remain focused on quality and long-term value, report Richard & Sophie Rogerson.

Acadata: Slowing housing market reflects falling confidence

Activity levels have recovered across England & Wales, but there's little optimism that prices will stage much of a recovery over the rest of 2025.

Stamp Duty ‘should be abolished as part of a wholesale reform of property taxation’

'SDLT certainly should not be increased,' declares an in-depth new report by the Institute for Fiscal Studies, and 'a well-designed tax system would have no place for SDLT at all.'

Abrahmsohn: Will we see a Christmas bonus for agents after the Budget?

Late November & December are notoriously tricky trading months - but this year could be different if Rachel Reeves decides to ditch the dreaded SDLT, writes the Glentree boss.

Property industry reactions: Tories pledge to ‘abolish’ Stamp Duty

Stamp Duty is 'a bad tax, an un-Conservative tax', says Kemi Badenoch.