Economics

Stamp Duty slashed in Kwarteng’s tax-cutting spree

The nil-rate Stamp Duty threshold has been doubled to £250k, effective from today.

BoE raises interest rates by 0.5% to 2.25%

The UK's base rate of interest has been rising since December 2021, as the Bank of England attempts to keep a lid on inflation.

Talking Heads: What would cutting Stamp Duty do to the housing market & economy?

It's being reported that Friday's "emergency mini-Budget" will feature a cut to Stamp Duty. Is this wise, and what impact might such a move have on the property market and on the wider UK economy?

Abrahmsohn on Truss’s ‘refreshingly radical’ plan to cut taxes

Super-prime estate agent Trevor Abrahmsohn hopes the new Prime Minister 'will succeed and be our Queen Boadicea in difficult economic times'.

Truss set to cut Stamp Duty to ‘encourage economic growth’

The Prime Minister and Chancellor will announce a reduction in property transaction taxes on Friday, suggests The Times.

Inflation-linked S106 payments ‘could be the straw that breaks the camel’s back for some developments’

"Some projects could become economically unviable if local authorities force developers to increase Section 106 agreements in line with runaway inflation," warns Boodle Hatfield.

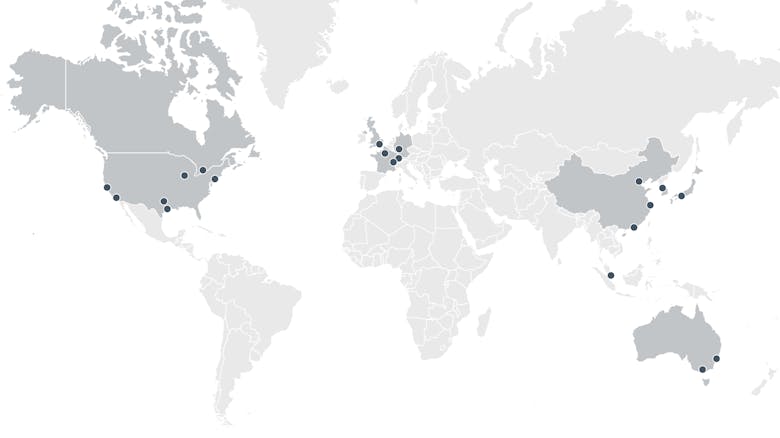

Ranked: The world’s millionaire capitals in 2022

London has fallen further down the wealthiest city rankings, with fewer millionaires now calling the UK capital home than New York, Tokyo and San Francisco.

BoE delays interest rate decision

"In light of the period of national mourning now being observed in the United Kingdom, the September 2022 meeting of the Monetary Policy Committee has been postponed for a period of one week."

History says Britain’s property market is in for a long slowdown, not a crash

A house price correction of between 10% and 20% looks increasingly likely, writes Colin Jones, Professor of Real Estate at Heriot-Watt University.

Abrahmsohn: What effect will ‘Trussonomics’ have on resi property?

Unless the economic scene changes dramatically, a cataclysmic collapse in property values is unlikely, says the Glentree boss.

HSBC warns of a looming house price crash

Another influential team of analysts expects a sharp downturn for Britain's property market, with London house prices likely to fall 15%.

‘We keep waiting for house prices to plateau, but it’s just not happening’

London estate agency Benham & Reeves expects house prices to rise by another 5% before the end of the year.