Sales

Sales supply climbs to a two-year high

Propertymark's latest survey suggests a significant increase in the number of homes being listed for sale, while buyer demand remains stable.

‘Promising signs’ for Prime London’s property market as under offers jump by 22%

Buyers have remained active despite ongoing challenges and a strong pipeline of sales is building, reports LonRes.

Industry Reactions: Official data shows UK house prices climb for a sixth consecutive month

Property values increased by an average of 2.8% in the 12 months to August 2024, according to the latest UK HPI, up from +1.8% annual growth in the previous month.

RE Confidential: On maintaining privacy in prime property deals

Lawyer Hugh Wigzell explains how high-profile clients can protect themselves before, during & after a significant purchase.

Ranked: London parks with the highest house price premiums

Today's buyers are placing much more value on proximity to green spaces, reports Savills.

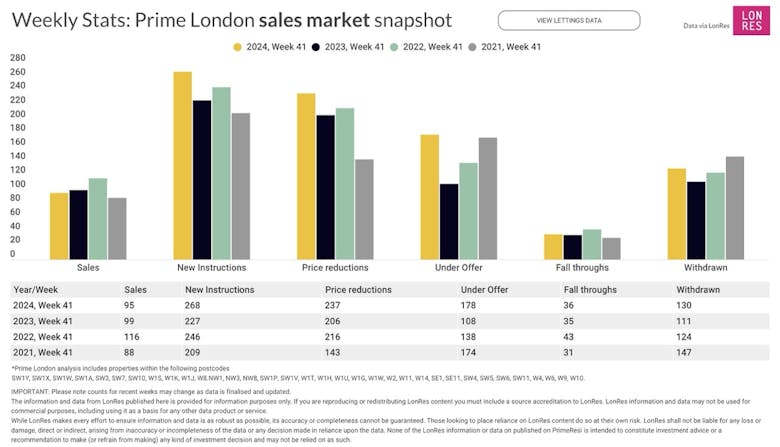

Prime London Property Market Snapshot: Week 41, 2024

The cumulative total number of residential sales agreed across prime London so far this year has tracked last year's tally remarkably closely.

‘Good news for estate agents’ as sales agreed jump by nearly a quarter

Lower mortgage rates have fuelled a rise in demand, reports TwentyCi, but many buyers are holding back until after the Budget.

‘A clear picture of a buyers’ market’ as listings rise

Q3 data suggest 'a significant gap between supply & demand', says Landmark Information Group.

Self-employed agents ‘making inroads’ into higher-end markets

Adoption of the self-employed model is growing across the UK, new analysis suggests, but overall market share of exchanges is still only 2%.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from the RICS, HMRC, Knight Frank, Adam Smith Institute & more...

Alex Michelin: Why London’s super-prime buyers are no longer driven by location

The significance of postcodes is fading, explains the influential luxury property developer, while demand for unique, individualised homes is rising.

House prices are climbing fastest in historic towns & commuter hotspots

While new towns have seen little-to-no house price growth in the last year.