Investment

Most HNWIs plan to increase investment in UK property, suggests survey

High net worth investors view economic instability 'as an opportunity for increasing their exposure to UK property at an attractive price point,' says Investec.

‘Froth comes off’ luxury asset prices

Knight Frank's index of 'investments of passion' fell for only the second time last year, despite some record-breaking sales.

13 key findings from Knight Frank’s 2024 Wealth Report, and 5 big themes shaping real estate markets this year

The property consultancy's 18th flagship research report delves into real estate investment drivers, global economic and policy shifts, HNW lifestyle trends, luxury collectibles, AI, sustainability and…

Ranked: London property Vs eight other investments over the last decade

'Bricks and mortar has remained one of the most consistent investments one can make down the years and the long-term returns speak for themselves,' says Foxtons' boss.

River Thames marina & houseboat moorings seek a new owner

Thames Ditton Marina in Surrey is on the market for the first time in nearly 20 years.

Currency Matters: The question isn’t whether, it’s when

David Huggett reports on the interplay between real estate markets, currency prices, and interest rates - and what the latest shift might mean for global economies...

Ranked: The cost of buying, holding & selling a $2mn property around the world

For international buyers, the purchase price is only part of the cost equation, so how does London compare on the world stage?

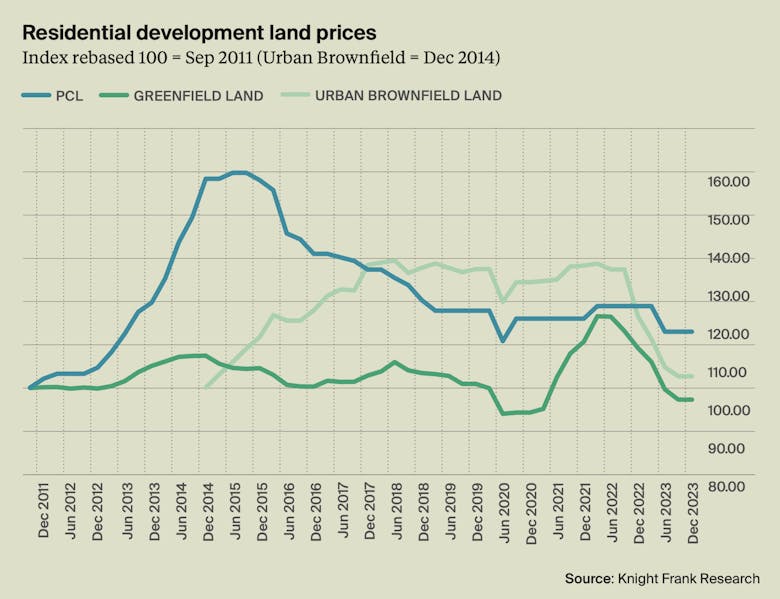

Development land market ‘set for rebound’ as housebuilder confidence builds

Knight Frank is advising property developers to 'replenish their land banks to keep up with improving housing demand.'

Striking a Balance: Tanya Hasking on why the regulatory load on landlords should be eased

'The regulatory pendulum has swung too far,' argues John D Wood's lettings chief, and it is time for a recalibration of red tape 'to create an environment where landlords can freely enter and exit the…

Savills heralds ‘significant opportunity’ for property investors ‘to buy at the bottom of the market’ in 2024

'There will be significant opportunity – especially in the commercial and residential spaces – for investors to buy at the bottom of the market,' says Savills, as the property firm shares its forecasts…

Buy-to-let purchases drop as landlords ‘hibernate’

Investors are buying fewer rental properties than at any time since 2010, according to fresh Hamptons data.