Investment

Fifth Wall expands into Europe with $140mn proptech fund

US VC firm’s oversubscribed European Real Estate Technology Fund will target investments in ‘high-potential’ start-ups

Landlords shun older properties as energy efficiency gains value

Changes to EPC rental standards are "likely to mean older homes will become considerably less attractive to landlords," says Hamptons.

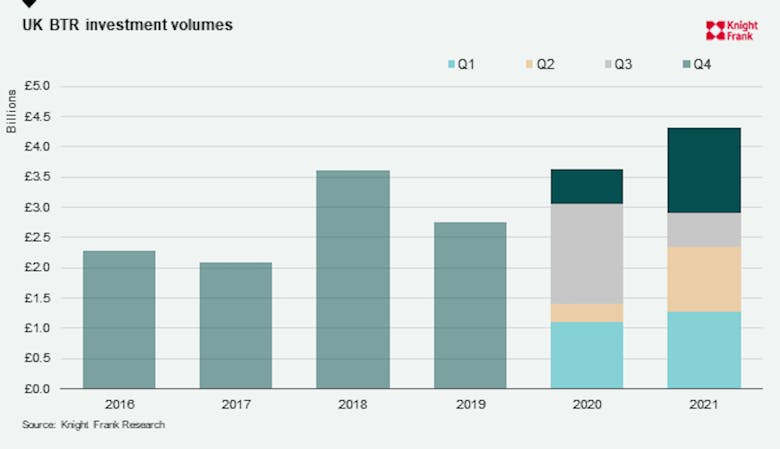

Build-to-rent investment tops £4bn

Institutional investment in purpose-built rental homes jumped by 19% last year, while deal volumes leapt by a third.

Global resi investment outstripped offices for the first time last year

Total investment volumes bounced back 'very strongly' in 2021, reports Savills, as more funds looked to get into real estate

Zoopla-backer Octopus pumps £5m into Homesearch

Giles Ellwood's proptech start-up has secured major investment to fuel "ambitious growth".

Savills adds Operational Capital Markets director

Ed Crockett has joined Savills from abrdn, where he was head of UK Residential Investment.

Investors pump record amounts into UK build-to-rent projects

14% more capital was invested into the UK's build-to-rent sector last year than in any other year.

December’s rate hike makes January a unique opportunity for borrowers

Lenders get hit with new targets at the beginning of the year and CEOs will want to make hay while the going is good, writes Alex Ogario

Warwick Investments builds PCL rental presence with off-market Mayfair mansion acquisition

Warwick Investment Group - run in the UK by former CPC exec Andrew Chrysostomou - is building an impressive portfolio of prime rental properties in Mayfair and Belgravia.

BTR investment to soar by 65% next year – CBRE

A growing economy and a strengthening of the labour market will provide a positive backdrop for UK real estate in 2022, says the global agency in its latest set of cross-sector forecasts

Proptech investment reaches a record high

“Proptech investment is growing significantly year-on-year, as the real estate sector is increasingly aware of the operational performance gaps that have been unaddressed for a number of years," says…

Reubens reportedly ‘on the verge’ of £180m Admiralty Arch deal

Sky News suggests that the Reubens family is about to become "a significant shareholder" in the ultra-luxury development of Admiralty Arch.