International Markets

The Doer Upper’s Postcard from Paris

A serial property developer tells his origin story, and fears for the future of London

London is the second-best global city for real estate investment

USA dominates the latest Schroders Global Cities 30 index

Global house price index records highest rate of growth for three years

Despite all the uncertainty and cooling measures in Asia, more countries around the world are posting double-digit increases...

Ranked: The world’s top ten multi-millionaire cities

London tops the table for the most resident multi-millionaires and for HNW importance, but not for billionaire population

Millionaires say that now is ‘the most unpredictable period in history’

A survey of 3,000 millionaires Trumpets a dramatic claim - but HNWIs are still feeling positive

The Price of Luxury: PSF values in the world’s prime resi enclaves

What does $1m, $5m, $10m, $50m, $100m and $250m buy around the world? Christie's International investigates...

London loses its luxury property crown to Hong Kong in ‘year of the trophy home’

Global luxury property markets are growing despite everything, with a record ten $100m+ deals flying through in 2016

‘Brexit = buying opportunity for Chinese’, claims portal as investment surges

Chinese investors in Britain are "undaunted" by Brexit, with searches for residential property up by a third, says Juwai.com

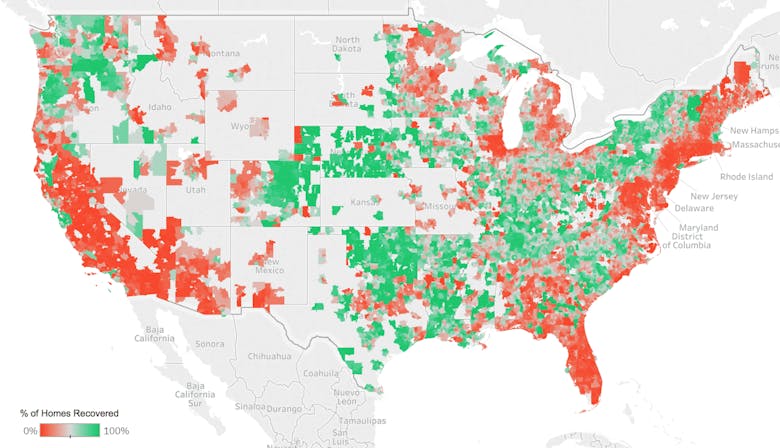

Only a third of US homes have recovered to pre-recession values

"The US won’t see 100% of homes reach their pre-recession peak until approximately September 2025", says Trulia

Chinese cities and tech hubs drive global prime property price growth up

Emerging tech hubs outperform established global finance centres

How Monaco plans to stay on top of the world

Record year sees tiny Principality overtake Hong Kong to become the most expensive resi real estate market on the planet...

Infography: Global property prices rise for the 16th consecutive quarter

But countries can be divided into three categories: Boom, Bust & Boom, and Boom