International Markets

Covid-19’s impact on global property markets ‘will likely be less than in the global financial crisis’

"A full house price crash [is] a distinct possibility," warns Oxford Economics as it assesses the potential fallout of the Covid-19 pandemic on global markets.

Interest in other countries ‘plummets’ as Hong Kong buyers hone in on UK market

Applications for British passports have 'skyrocketed' since the UK’s announcement of a path to citizenship, according to immigration specialists...

153 $10m+ sales worth $3.2bn: How the world’s super-prime markets fared under lockdowns

Activity may have plunged, but global super-prime property markets "outperformed expectations" under lockdown, reports Knight Frank, with 153 sales going through above $10m since March.

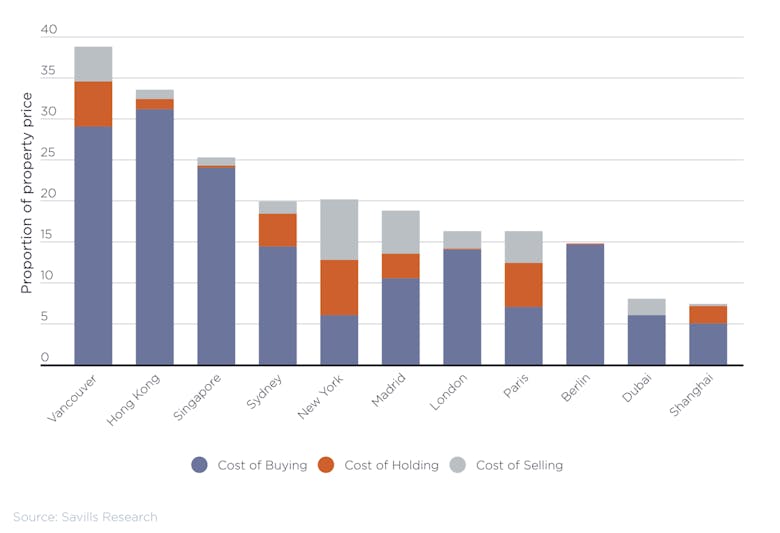

Buy, Hold & Sell: How expensive are London’s property taxes on the world stage?

New research reveals the associated costs of buying, holding and then selling a property around the globe...

Rightmove reports record day for overseas home-hunting as travel restrictions are eased

Sunday 28th June was the first ever day that more than one million searches were performed on Rightmove Overseas.

The global billionaire population grew by 8.5% in 2019, reaching an all-time high

Over 10% of the world's billionaires have donated something towards the fight against Covid-19 so far, according to some research by Wealth-X.

Knight Frank expects global city price growth rankings ‘to look very different in six to 12 months’ time’

The Global Residential Cities Index increased by 4.3% in the 12 months to March, its highest annual rate of growth since Q3 2017.

Hong Kong buyers ‘dominating’ London’s luxury apartment market – Almacantar

Developer behind Centre Point & The Bryanston reports an influx of demand from the region, driven by the UK’s recent visa announcement and the upcoming SDLT surcharge.

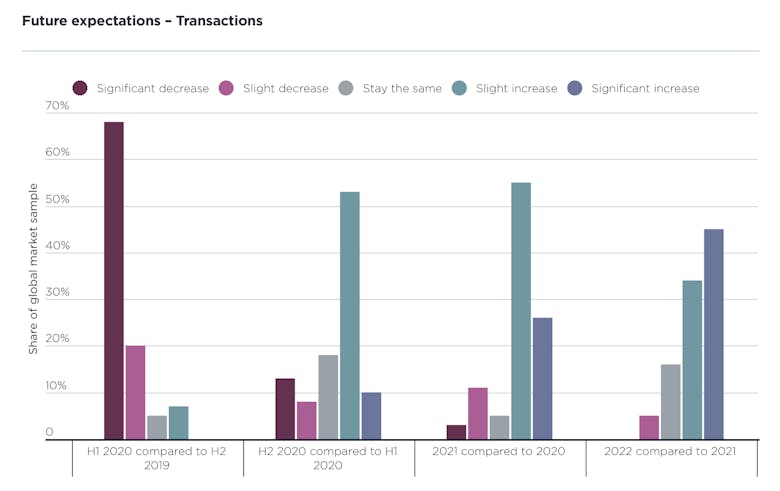

Activity returns to global property markets, but there’s a ‘disconnect’ between buyers & sellers on pricing

Residential property activity in China "has largely returned to normal" after two or three months out of lockdown, reports Savills.

Pandemic pushes expats to buy homes ‘back home’

A rising number of expats are looking to move "back home" as the impact of the Coronavirus pandemic unfolds, according to a survey of prime-oriented Knight Frank brokers around the world.

Lockdown drives a surge of UK interest in overseas properties

There's been 33% year-on-year jump in the number of visits to Rightmove Overseas during the Coronavirus lockdown.

Global housing markets ‘are displaying a surprising degree of resilience’

Residential activity is recovering quickly in many international markets as Coronavirus lockdowns are eased.