International Markets

Ranked: The world’s millionaire capitals in 2022

London has fallen further down the wealthiest city rankings, with fewer millionaires now calling the UK capital home than New York, Tokyo and San Francisco.

Trendwatch: New global hotspots emerge as luxury homebuyers hunt for value

'With home prices at or near peak levels in many luxury markets, high-end buyers around the globe are discovering markets where they wield more buying power,' reports Christie's International Real Estate.

Global housing markets continue to climb, despite everything

"Global housing markets have wrongfooted us this quarter," says the Knight Frank research team, as property markets continued to post strong growth.

Ranked: The world’s most liveable cities in 2022, as standards ‘return to pre-pandemic heights’

The world is getting back to something like its pre-Covid self, according to researchers at the Economist Intelligence Unit.

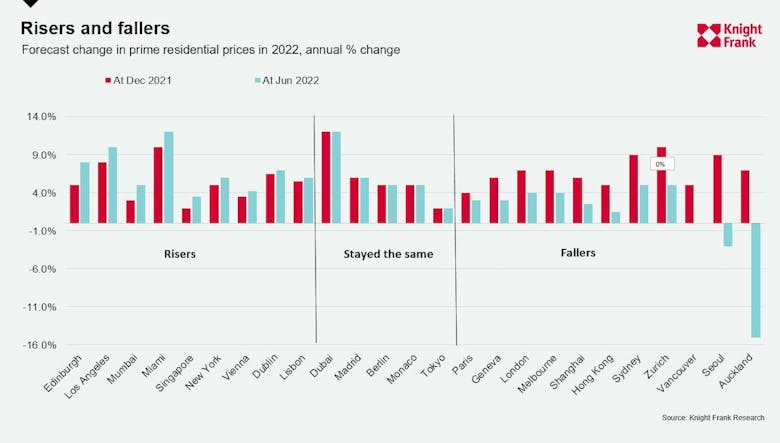

Knight Frank downgrades international prime property price forecasts

"A lot has changed in global property markets since we issued our last global prime residential forecast in December 2021," says Knight Frank.

Waterfront price premiums rise around the world as demand surges

The average international premium for a waterfront property compared with a non-waterfront home has climbed to 40%, according to Knight Frank.

Prime rental growth outpaces capital values in most global cities

“Megacities are once again thriving as tenants are drawn back to urban living after the lifting of lockdowns," says Savills, as prime rents climb in New York, Singapore, London and Los Angeles.

‘The winds of change are blowing through global property markets’ as price growth slows

Knight Frank's latest international index tells of cooling housing markets around the world, including at the top end.

The Guardian: Era of soaring house prices is ending as central banks raise rates

"It's over," declares The Guardian's Economics Editor, Larry Elliott. "An era of ever-rising house prices stimulated by cheap money is coming to an end."

Trendwatch: US buyers go bargain hunting in Europe

Knight Frank reports on the current surge of American interest in European property markets.

Prime resi prices continue to climb in major global cities

US cities have seen the highest rates of prime property price growth in the last six months, reports Savills, as the firm predicts a slight slowdown across most world cities in the second half of this…