International Markets

British cities tumble down global ‘liveability’ rankings

Vienna once again tops The Economist Intelligence Unit's list of the world's 'most liveable' cities.

Prime global rents climb to record highs, but the pace of growth is easing

Singapore and London have seen the biggest prime rental price increases over the last year, according to Knight Frank's latest city index.

Mapped: House price growth around the world

Using data from the Bank for International Settlements, Visual Capitalist has charted rates of both nominal and real property price growth...

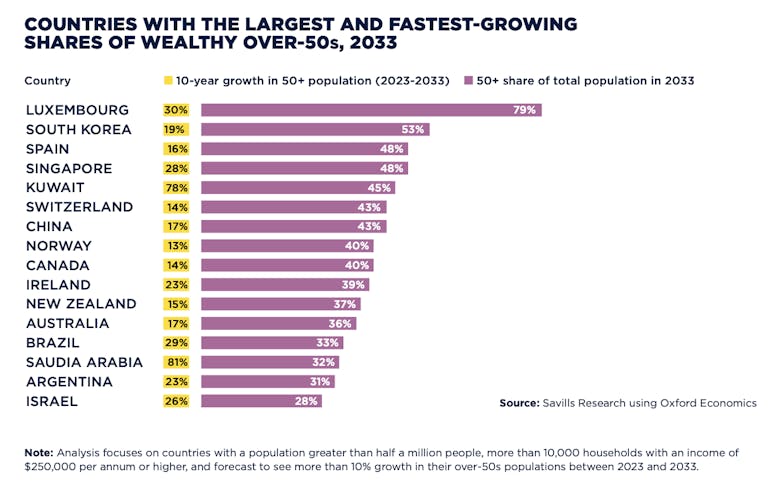

Aging populations mean ‘prime of life’ buyers to drive global top-end property markets over the next decade

"Populations that are getting older also tend to be getting wealthier," says Savills as it highlights implications for residential markets around the world.

Who run the world? Global luxury property market ‘is undergoing a significant transformation’ as demographics shift

More than half the world's luxury homeowners under 35 are women, according to a new survey.

‘The stars are aligning’: Why Paris is packing a punch in 2023

'Paris has stolen a march on its European neighbours,' says Knight Frank's Global Head of Residential Research, Kate Everett-Allen.

Ranked: America’s branded residence hotspots

South Florida and São Paolo lead the way for branded residential property development in North America.

Paris to block high-rise building again under new ‘bioclimatic’ planning regime

French capital to create new public parks as it seeks to combat housing shortages and mitigate the effects of climate change.

Dubai leads global super-prime sales bounce, as £10mn+ deals falter in London

International super-prime property market activity 'slowed noticeably' last year, says Knight Frank - but things perked up again at the start of 2023.

Global HNWI population & wealth sees biggest decline in over a decade

The super-rich are now prioritising wealth preservation rather than wealth creation, says CapGemini.

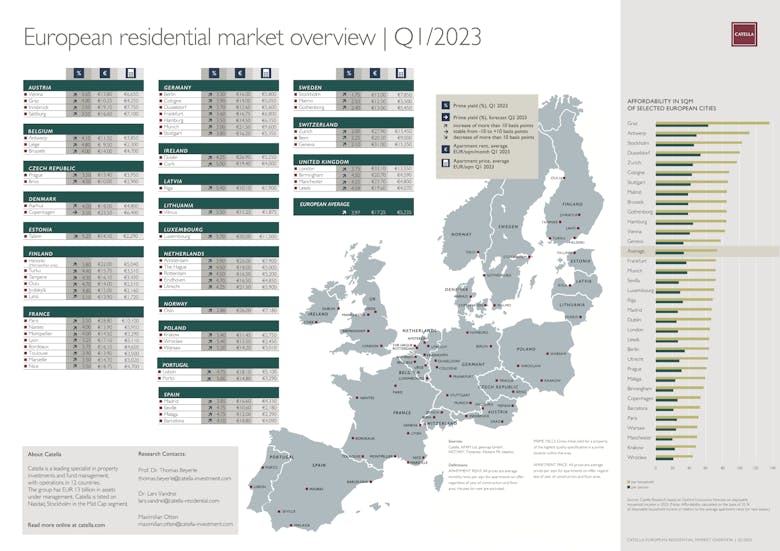

Europe’s decade-long residential property bull run is ‘under strong pressure’

Resi valuations across Europe are 'stagnating due to the wide gap in expectations between most buyers and sellers,' says Catella Research, but a new 'lower consensus price floor' is emerging.

How Macron has made France a ‘haven’ for HNW property buyers

'President Macron has been proactive in attracting HNWI’s and digital nomads to France,' argues Leggett Immobilier - leading to a surge of luxury property deals in the last few years.