International Markets

Global residential rents tick higher but affordability begins to bite

Slower growth in top-tier rental markets such as New York and Singapore 'points to the likely direction of travel for big city markets,' says Knight Frank.

Property price declines are ‘running out of steam’ in most major markets

Oxford Economics thinks 'further significant corrections are unlikely' for global house prices.

Two in five Europeans plan to move home within the next two years, suggests report

'The desire for relocation in Europe remains steadfast' despite a slowing property market, says RE/MAX after quizzing 22,000 people across the continent.

Residential rents continue to climb across Europe, despite falling property prices

'The gap between rents and values shows no signs of closing', says Catella.

Ski chalet prices continue to climb as Alpine resorts evolve

'The pandemic-induced Alpine mini boom is ending with a fizzle rather than a bang,' says Knight Frank.

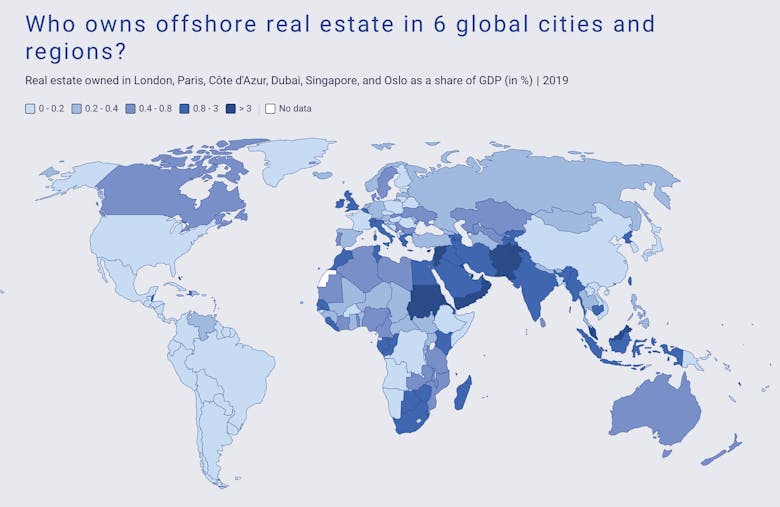

‘Introduce a new global minimum tax for the world’s billionaires’: Six recommendations to ‘reconcile globalisation with tax justice’

Renowned economist Joseph Stiglitz is amongst those proposing 'an ambitious and yet pragmatic agenda for the coming years to move towards a fairer international tax system.'

Postcard from Greece: Property market players ‘have moved away from a cautious approach’

In the latest PrimeResi dispatch from Luxury Portfolio International, Jeronymo Kontonis notes a growing sense of optimism in top-end Greek property markets, and highlights some major developments and key…

‘UK property is the darling of GCC investor portfolios’

The majority of high net worth investors from Saudi Arabia, Qatar and the UAE say their confidence in the UK property market has increased over the last 12 months, reports Al Rayan Bank.

Continued global luxury house price growth ‘shouldn’t be overstated’

Two-thirds of cities tracked by Knight Frank's Prime Global Cities Index have seen property values increase through the last year.

Postcard from Paris: Susie Hollands on the French capital’s ‘striking parallel’ with the Prime Central London property market

The city of love still holds dear to global buyers, says a top Parisian buying agent.

‘London appears to have lost its crown’ as super-rich population falls

American cities dominate a new list of top cities for 'centi-millionaires', while London's popularity amongst the global super-rich appears to be waning.

Postcard from LA: Gordon MacGeachy on the mansion tax, pyjama lounges & off-market records

In the latest in a series of international dispatches for PrimeResi, Hilton & Hyland's Estates Director - a member of Luxury Portfolio International - shares insights into the Californian luxury property…