Finance

Current market conditions ‘ripe for opportunistic foreign investors’

Development consultancy Arcadis has joined the voices predicting a boost for the UK's prime resi market as sterling continues to take a beating in the wake of the Brexit vote.

Commercial property emerges as the sick man of Brexit

The commercial property sector looks to be having the worst of it in the immediate aftermath of Britain's vote to leave the EU: three four six major investment funds have pulled up drawbridges as private…

Mortgage lender recruits Engineering VP to scale up tech side of the business

Specialist mortgage lender Lendinvest has hired its first VP of Engineering to help "scale up the technology side of the business."

Mike Nuttall joins the firm from online printing company Moo.

Plentific raises £2m in funding

Proptech startup Plentific has raised a chunky £2m in funding from its latest round of investment.

The Macro View: Brexit’s impact on UK commercial and investment real estate

London is likely to be hit with some corporate relocations and demand drops, says UBS, but there are several silver linings to focus on

London property lenders put on hold as Brexit uncertainty grips

Singapore's third largest lender, UOB, has suspended its loans programme in London "for the time being" in the wake of Britain's vote to exit the European Union, and a UK bridging lender has "paused" second…

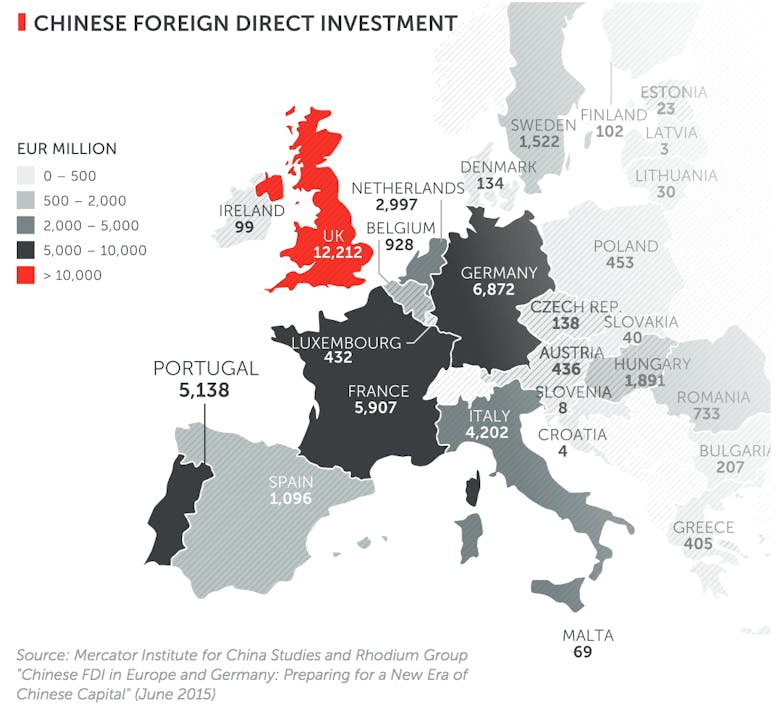

46% of Chinese buyers expect demand for UK property to increase post-Brexit

46% of potential Chinese buyers of UK property think that demand will rise in the wake of a British exit from the EU, according to a survey by Juwai.

New CFO at the Crown Estate

The Crown Estate has appointed Kate Bowyer as its new Chief Financial Officer.

Eurozone buyers ‘snapping up bargains in London’ as currency wobbles offer discounts

Euro buyers have been grabbing £26,000 discounts on London property, says Stirling Ackroyd, as EU Referendum nerves caused sterling to nosedive in June.

Rare Notting Hill investment/development opp listed at £12m

A rather unusual development-slash-investment opportunity has come up on the Ladbroke Estate in the middle of prime W11.

Bank lending to property developers halves in two years

Bank lending to UK property developers has halved over the past two years, according to new stats out today.

Funding platform Saving Stream says the figure dropped from £32.5 billion to £14.

£6m house ‘that pays for itself’ goes on sale in New York

A Renaissance Revival-style townhouse on the Upper West Side of Manhattan has been launched onto the market with a rather unusual sales pitch.

306 West 78th Street is being billed by agents Leslie J.