Finance

Property developer inks $1bn ‘tokenization’ deal, taking real estate assets to blockchain

'Tokenising our assets will provide investors with a secure, transparent, and convenient way to access a wide range of investment opportunities,' says major Middle Eastern real estate conglomerate.

Stamp Duty payments should be ‘spread over 20 years’ – Tony Blair Institute

'Stamp duty is long overdue reform,' declares the TBI's Director of Economic Policy on the day SDLT bills jump up.

Industry Reactions: Mortgage approvals slide again

'A minor slip in mortgage approvals in February adds weight to the narrative that the housing market recovery has lost some momentum,' says Lucian Cook of Savills

Required Reading: No surprise measures in the Chancellor’s Spring Statement

Mishcon de Reya's Private Wealth & Tax team explain what the government's Spring Statement means for high net worth individuals & business owners.

Douglas & Gordon launches £200mn+ property lending platform

James Evans' D&G has teamed up with Paul Oberschneider's Hilltop Capital Partners to create a new bridging finance platform.

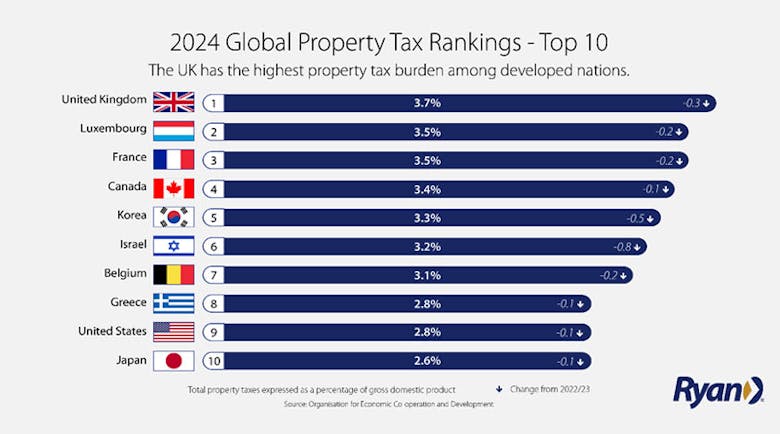

UK is home to the highest property taxes in the developed world – claim

Real estate tax revenues account for more than 3% of GDP in seven major economies - with the UK at the top.

Watch: Property industry leaders discuss housing market solutions & challenges

Market movements & macroeconomic trends were on the agenda at the tenth edition of Deverell Smith's annual 'Banking on the Future' event.

Property Industry Reactions: BoE holds interest rates at 4.5%

'While a hold in rates will be disappointing for borrowers, it does suggest a welcome level of stability', comments property portal boss Jason Tebb.

Required Reading: What property owners need to know about incoming empty home Council Tax premiums

New relief exemptions only apply if the property is up for sale, writes lawyer Matt Crawford.

Cadogan recruits Capital & Regional heavyweight

New FD Stuart Wetherly has been brought in to support the great estate 'through its financial strategy and continued growth'.

Letting agents urged to get ahead of new sanctions rules

Failure to comply could lead to big fines or even criminal prosecution.

Family offices ‘keen to broaden their exposure to real estate’ investments

Luxury residential property is a key asset and a rising investment target for many of the wealthy families surveyed by Knight Frank for its Wealth Report 2025.