Finance

Précis Capital secures £1bn backing from Canadian investor; rebrands

Recently-launched real estate lender has significantly increased its firepower, and rebranded to Precede Capital.

Tom Bill: ‘Taking the right mortgage at the right time could prove more fruitful than waiting for prices to bottom out’

Track the mortgage market not house price data to get the timing right in 2023, says KF's head of UK resi research.

Mortgage approvals drop to lowest level since June 2020

Fewer house purchase mortgages were approved in November 2022, as interest rates climbed.

Los Angeles Times: L.A.’s rich are already scheming ways to avoid new ‘mansion tax’

'Rich people are very clever,' says a real estate broker in California. 'They know how to manage cash, and they have time to look for loopholes.'

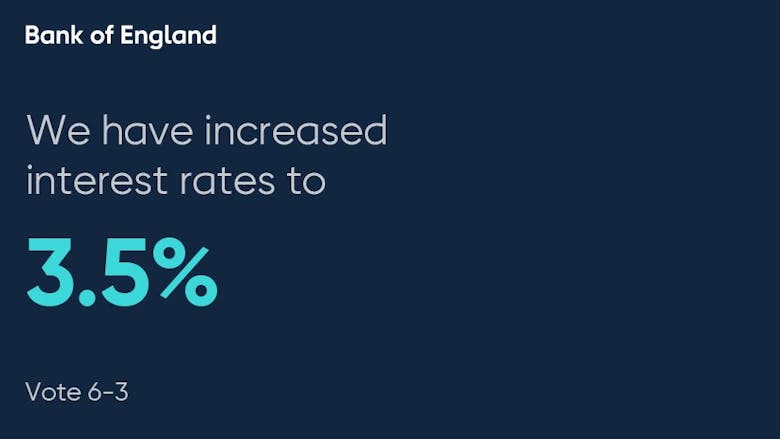

BoE bumps interest rates up again, to 3.5%

Interest rates continue to climb as the BoE attempts to bring CPI inflation down.

On a rare mixed-use SDLT success for the taxpayer

The buyer of a barn conversion with 39 acres has managed to pull-off a 'rare win' to pay the lower Stamp Duty rate for mixed-use properties, says Helen Coward of Charles Russell Speechlys.

Mike Boles: What’s in store for high-value mortgages?

It's been a turbulent few weeks on the lending front: Mike Boles explains what this means for borrowers...

Home-buyers pick longer mortgage terms

Over a quarter of home-mover mortgages secured in Q3 were for terms of more than 30 years, up from fewer than one in ten a decade ago.

Mortgage lending slumps as interest rates rise

The latest Bank of England data shows a sharp drop in mortgage lending and mortgage approvals in the aftermath of the short-lived mini-Budget.

Mapped: The markets most insulated from rising mortgage costs

Prime property markets are relatively insulated from mortgage rate hikes, says Knight Frank - but transaction numbers are still likely to drop-off in the coming years as the wider housing market cools.

£8.5mn loan agreed for £16mn mansion project on the Wentworth Estate

CapitalRise has agreed a big finance package to create a new super-prime mansion in Virginia Water.

Rising interest rates: Why the Bank of England has increased rates again and what to expect next

Financial markets are currently forecasting interest rates of around 4.