Finance

Grosvenor kicks off £120mn resi debt strategy

Loans of up to £30mn will support projects with 'strong social and sustainability credentials'

10 Years of ATED: On the past, present & future of the Annual Tax on Enveloped Dwellings

Law firm Burges Salmon looks back at how the Annual Tax on Enveloped Dwellings (ATED) has evolved and affected the property market since being introduced in 2013, and considers what may lie ahead for the…

Century follows £100mn fund raise with ‘record’ week

Mayfair-based lender notched up £32.5mn of deals involving prime assets in London and the country.

Mortgage approvals rise for the first time since August

But approvals are still running a third below their pre-pandemic average.

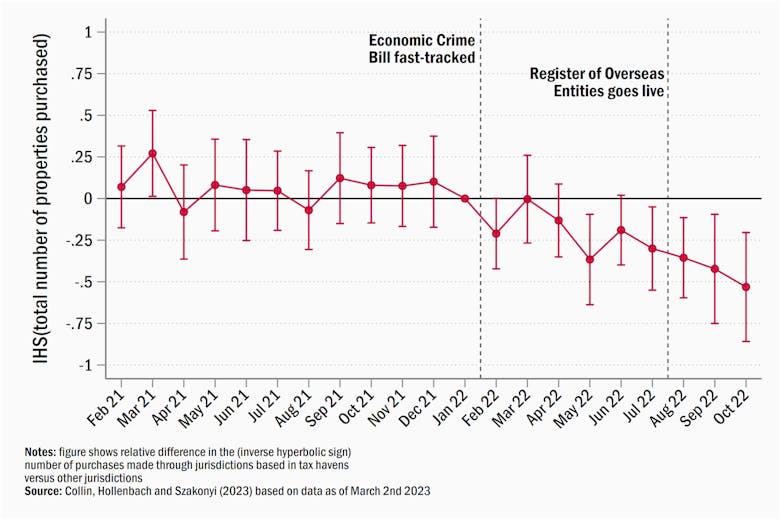

The Register of Overseas Entities seems to be working, as UK property deals involving tax havens fall

New research suggests improved transparency in the property market means 'Londongrad' is losing its appeal to corrupt money...

Lendinvest opens-up resi mortgage products

Lloyds-backed tech-driven mortgage platform has formally entered into the UK’s £1.2 trillion homeowner mortgage market.

Interest rates rise again, to 4.25%: Industry reactions

The Bank of England's Monetary Policy Committee has raised the base rate for the 11th month in a row.

Precede Capital adds two new faces

Real estate development lender has recruited a new Associate Director from Green Street, and a Senior Associate from Reed Smith.

Currency matters: The banking sector sneezed, but no one seemed to catch a cold. Yet.

David Huggett updates on the latest movements on the world's financial markets, and how the recent turmoil might affect international investors in the UK...

11 key takeaways: The Budget 2023 for HNWIs & business owners

Required Reading: Mishcon de Reya provides an essential briefing on the key announcements in yesterday's Budget statement, highlighting 11 need-to-know policy and tax changes...

‘We wanted to see more’ Vs. ‘Thank goodness the Chancellor decided to leave the property market well alone’: Housing industry reactions to the 2023 Spring Budget

A 'missed opportunity' or is 'no action the best stance'? Here's what the property industry makes of Jeremy Hunt's latest round fiscal policy updates...

Budget 2023: Chancellor keeps hands off the housing sector

Property was largely absent from Jeremy Hunt's Spring Budget statement.