Act by 5 April 2013 to wipe out capital gains on second homes, buy-to-lets and shares

What does April’s new Capital Gains Tax mean for high value UK property?

Corporate owners of £2m+ properties in the UK need to act now to stay on top of the latest tax regime changes, say Andrew Goldstone, Kassim Meghjee and Jonathan Legg of Mishcon de Reya.

By Prime Resi

Required Reading: UK Capital Gains tax for non-residents?

There has been recent speculation that non-residents might have to start paying UK capital gains tax (CGT) on their UK property...

By Prime Resi

Required Reading: How to Buy and Sell Short Leases

Short leases; big opportunity or tall order? We asked Child & Child's Katie Cohen and Mo Hakim and Prosper Marr-Johnson of Marr Johnson & Stevens to put together the definitive crib sheet...

By Prime Resi

Most read

IWD2026: Prime resi industry leaders on the moments that changed everything

To mark International Women’s Day, senior figures from across the sector reflect on the decisions, risks & pivots that shaped their lives & careers - from ‘sliding doors’ moments to leaps of faith.

RBKC approves 100% premium on second homes

Bills to double from 2026/27 as council moves to address £100mn-plus funding gap.

Strutt & Parker recruits Savills’ Hampstead sales head

Heritage agency boosts new broker network with senior north London hire.

The New 2% Club: Jamie Hope on pricing in Prime Central London’s leaner market

The era of the ‘comfortable 10% cushion’ is over, says boutique agency boss - today’s market rewards accuracy, not optimism.

By Jamie Hope

High-profile private members club seeks Branded Residences Director

Soho House reveals it is 'launching a new Branded Residences vertical.'

By PrimeResi

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Andrew Thomas, a Lecturer in Middle East Studies and author of Iran and the West: A Non-Western Approach to Foreign Policy, explores 'a deliberate strategy by the Iranian government, designed to exact…

Super-prime rental deals surge in London

£5,000-per-week-plus tenancies up 8% year-on-year as internationally mobile tenants prioritise flexibility.

Tom Bill: How the Middle East conflict could affect the UK housing market

Rising energy prices and shifting rate expectations could reshape mortgage costs and buyer sentiment, explains Knight Frank’s head of UK resi research.

By Tom Bill

Banking heavyweight flags postcode divergence across Prime London market

Buying conditions are ‘favourable’, says Investec, as analysis points to opportunity across three key districts.

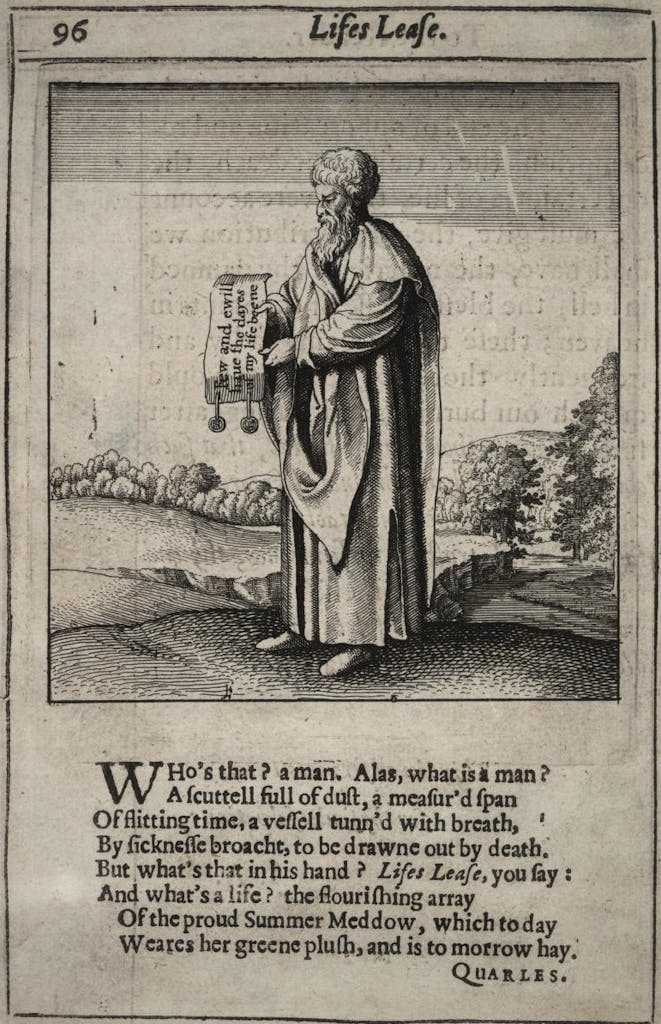

In Pictures: One of London’s oldest houses comes to market

Rare 17th-century survivor just off the Strand recently returned to resi use.

LATEST ARTICLES

Tom Bill: How the Middle East conflict could affect the UK housing market

Rising energy prices and shifting rate expectations could reshape mortgage costs and buyer sentiment, explains Knight Frank’s head of UK resi research.

By Tom Bill

Rare St George’s Hill plot with approved mansion plan hits the open market

Savills is pitching 'a remarkable canvas for a purchaser to build a home tailored to their individual requirements' in the affluent Surrey enclave.

By PrimeResi

eXp rolls into Luxembourg

The property brokerage launched in seven new territories last year, and aims to operate in 50 countries by 2030.

By PrimeResi

Weekly Showcase: Ten featured prime resi listings

PrimeResi's regular stock check, powered by LonRes

Ranked: London’s most ‘imbalanced’ housing markets

Prime Central locations tend to have a far more equal split between sales and rental listings, compared to outer boroughs.

By PrimeResi