Property Market News

‘Significant slowdown’ expected for prime London rents next year

Escalating costs of living and inflationary pressure are likely to slow the pace of prime rental price growth down in the coming months, says Savills - but the firm has still upgraded its five-year price…

Bank of England turns gloomier as base rate rises to 1.75%; how will the housing market respond, asks Tom Bill

Economists question the Bank’s latest forecasts while the direction of travel for mortgage costs is less open to debate, writes Knight Frank's head of UK residential research.

Monday Market Review: Key figures and findings from the last seven days (w/c 01.08.22)

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, Savills, Coutts, Zoopla, Knight Frank, London House & more…

Prime rental growth outpaces capital values in most global cities

“Megacities are once again thriving as tenants are drawn back to urban living after the lifting of lockdowns," says Savills, as prime rents climb in New York, Singapore, London and Los Angeles.

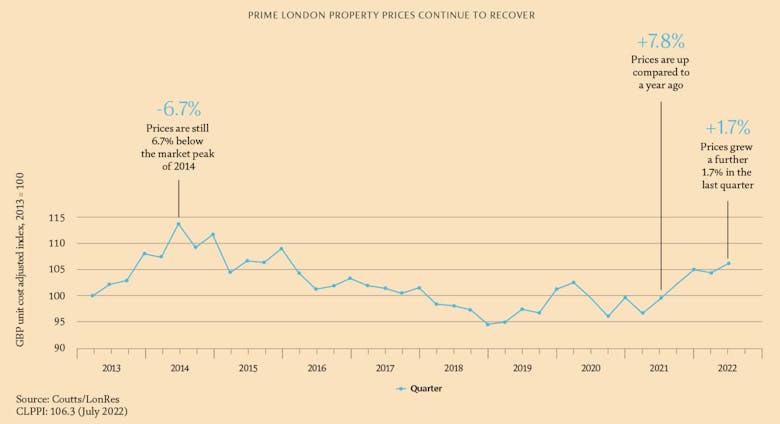

‘London’s prime property market is getting back on form’ – Coutts

High-society bank tells affluent clients that PCL is back in action.

Savills halves PCL price forecast for 2022

Prime Central London's property market recovery is taking longer than expected, says Savills, as it downgrades its forecast for this year.

Bank of England bumps interest rates up 0.5% to 1.75%; warns of a recession by the end of the year

Today's rate rise is the biggest increase in 27 years, and comes as the BoE warns that the UK will be in a long recession by the end of this year.

‘The winds of change are blowing through global property markets’ as price growth slows

Knight Frank's latest international index tells of cooling housing markets around the world, including at the top end.

£1mn+ home sales have jumped 93% in the last decade

Eight out of ten local authority areas in England and Wales have seen at least one £1mn+ property sale so far this year, up from only half in 2012.

Knight Frank’s head of resi on the markets to watch in H2

After a frantic first half, Tim Hyatt reviews the state of play in the prime sales, lettings and new homes markets - and looks at how the next six months could unfold…

Property market ‘is not slowing as fast as some might expect’ – Zoopla

Property portal predicts house price growth will slow to 5% by the end of this year, but buyer demand remains high in the face of rising interest rates and costs of living.

‘London exodus continues’ as a record proportion of first-time buyers leave the capital in search of a home

"One of the biggest Covid-related housing market trends - moving out of London for the country - could be here to stay," suggests Hamptons.