Property Market News

Country property market continues to surge as ‘more traditional rhythms’ emerge

Britain's country house market continues to romp along at pace, says Knight Frank, as "pent-up demand keeps the race for space alive.

41% of agents report the average property deal now takes more than four months to complete

Propertymark's July market snapshot tells of slowing buyer demand, as deals taking significantly longer to complete than in pre-pandemic times.

House price growth slows to +7.8%

The average UK property price increased by 1% from May to June this year, according to the latest official House Price Index.

The number of homes listed for sale has fallen 12.5% in the last year

Estate agencies have listed an average of 7.3 homes per branch across Britain in 2022 so far, down from an average of 8.4 in 2021, according to some new research.

Sharp drop in confidence amongst London property sellers

"The change in economic headwinds is starting to be reflected in seller confidence," says OnTheMarket.

Another top agency cuts Prime Central London property price forecasts

Strutt & Parker now expects PCL property prices to end this year 2-5% higher than they started it, having predicted 5-10% growth through 2022 just a few months ago.

Traditional Summer dip sees asking prices fall for first time this year – Rightmove

"Prices usually drop in August, and this 1.3% drop is on a par with the average August drop over the past ten years," explains the Rightmove team.

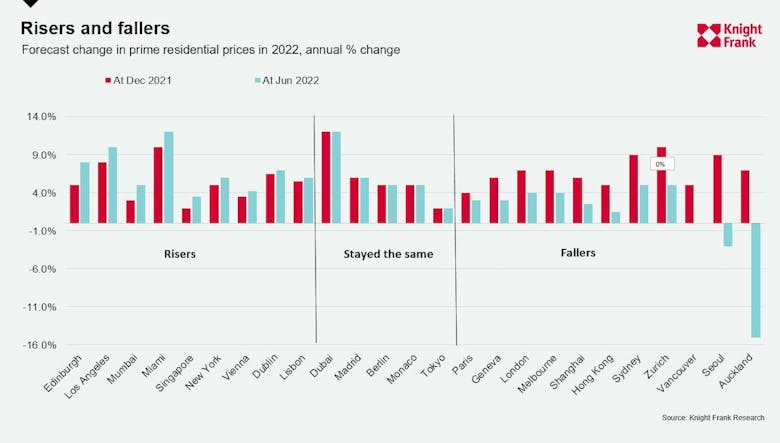

Knight Frank downgrades international prime property price forecasts

"A lot has changed in global property markets since we issued our last global prime residential forecast in December 2021," says Knight Frank.

House prices continue to climb despite falling buyer demand – RICS

"It is little surprise that housing market activity is now losing some momentum," says the RICS - but most surveyors "still anticipate prices will be modestly higher than current levels in a year’s time.

Market towns see property prices dip as the countryside property boom cools

After two years of punchy growth, house prices in 25 regional market towns have fallen by an average of 2% in the last 12 months.

Waterfront price premiums rise around the world as demand surges

The average international premium for a waterfront property compared with a non-waterfront home has climbed to 40%, according to Knight Frank.

Ranked: London’s most active property markets

Croydon (CR0), Wandsworth (SW18) and Merton (SW19) are the most active London areas for home-buying activity, with each postcode seeing more than 60 homes sold each month.