Property Market News

Proportion of overseas landlords rises for the first time since 2010

The weak Pound has boosted the proportion of British homes let by overseas landlords, from 7% last year to 11% this year, according to Hamptons;

Tenant demand continues to outstrip rental supply in London

Demand for rental properties in London has increased by 13% compared to last year, reports Foxtons, while supply has fallen by 16%

Market Snapshot: The top 5% across England & Wales

"The housing market is showing a remarkable stoicism given the backdrop of unmet Brexit deadlines, 'flextensions' and a December election," says Fine & Country, although prices and volumes at the top-end…

‘Chill winds returned to the London prime property market over the summer’ but ‘there are now reasons for optimism’

"Chill winds returned to the London prime property market over the summer," says Coutts bank, although "there are now reasons for optimism regarding a potential bottoming of the market"

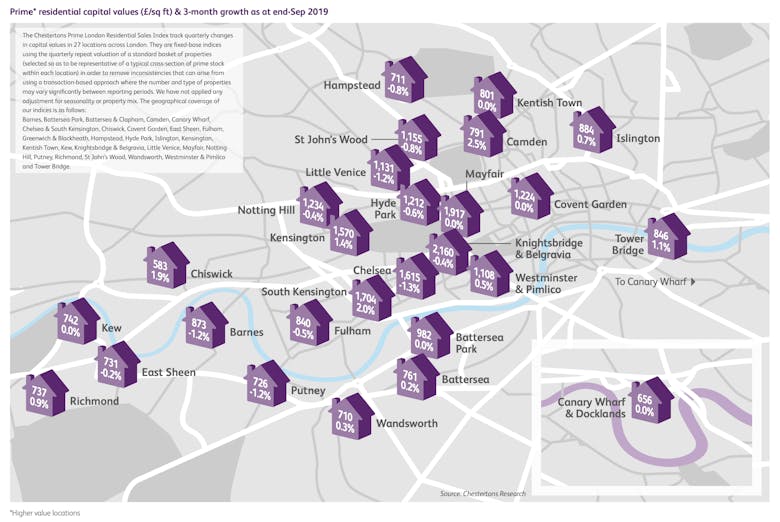

Competitive bids rise as London’s high-value property market rallies

Chestertons reports rising demand but continued short supply in prime London locations

‘Exceptionally strong tenant demand’ drives rental price growth in London

"The wider London market remains characterised by insufficient supply to match tenant demand", reports Chestertons - but prime tenants "remain price sensitive"

Northacre owner is ‘in discussions with a few’ big-ticket distressed development projects in PCL

"Brexit is fully priced in," says ADFG's CEO Jassim Alseddiqi. "I strongly believe there is pent-up demand in Central London residential that will be coming up very soon ...

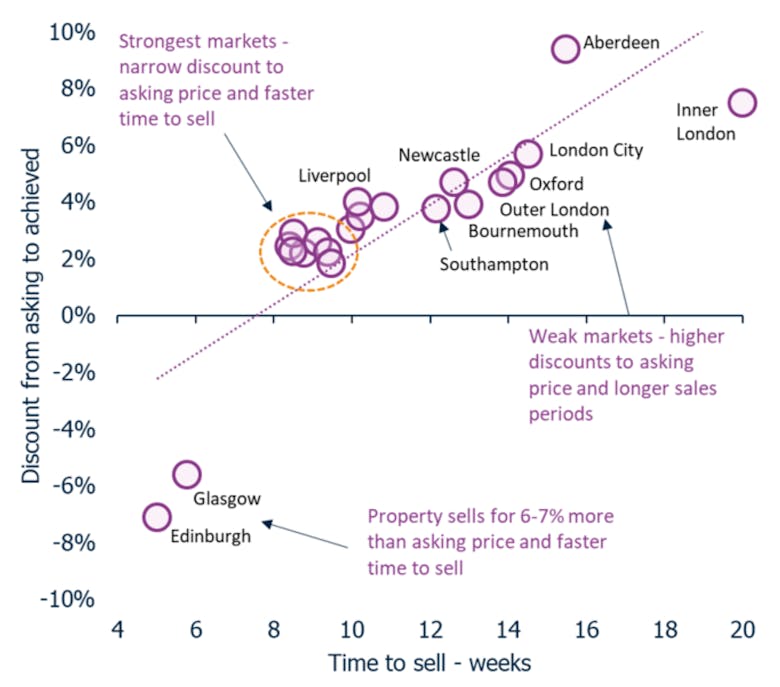

Average time to sell a home reaches a three-year high

Zoopla's latest index tells of a slow-moving property market in London and southern cities

New-build home registrations slow in Q3

39,364 new homes were registered with the NHBC over the last three months, compared to 43,403 a year ago

104 property sales worth £2.06bn: London’s super-prime market in five charts

Some fascinating insights into this year's £10m+ sales market from Knight Frank, including a flurry of £30m+ deals, building demand for super-prime, currency plays, and how UHNW buyers are getting younger…

Market Snapshot: Prime rents in London & the commuter belt

Prime London rents have risen for the first time since 2016, reports Savills, while rents in the commuter belt continue to fall

£1m+ deals have soared 12-fold in 20 years, as the average house price has almost tripled

Today's prime property market is "much bigger and more complex" than in 1999, says mortgage firm Private Finance as it charts the rise of seven-figure transactions over the past two decades