Property Market News

Westminster crowned London’s ‘best performing’ borough for property in 2019

From house price growth to sustainability, rental value to construction activity, CBRE has totted-up the property performance of each London borough in 2019 - coming up with a series of top ten "winners"...

Property market sticks in the doldrums, but surveyors are more positive about 2020

"The medium term view of the market remains surprisingly sanguine", according to the latest RICS monthly survey

Ranked: Which UK property markets have bounced back most from the Global Financial Crisis?

Average property prices in some areas of London are now 89% higher than their pre-crash peak... Other parts of the country are still 38% below 2007's level.

‘Steep rise’ in prime London tenancy agreements as demand escalates

Knight Frank reports a 46% jump in agreed tenancies under £1,000 pw in prime London

Paris predicted to lead global prime property price growth in 2020

Knight Frank flags nine global prime resi trends to monitor in 2020, while picking which prime global cities are likely to see rising house prices in the coming year - and which are set for price falls.

London house prices ‘show return to health for the first time in three years’

Property prices in UK cities have risen by an average of 2.9% in the last year, reports Zoopla; the number of London postcodes recording price falls has dropped from 82% last year to 23% in October.

‘Certainty will return to the UK housing market’, predicts JLL in an upbeat set of forecasts

Property firm prophecies "the end of a long period of uncertainty" in London and around the country - with positive growth on the cards for house prices, transaction volumes and rental values.

2% or 28%: Agency offers two five-year PCL property price forecast scenarios

House prices in Prime Central London could end 2023 just 2% higher than in 2019, predicts Strutt & Parker - or they could climb by 28% if Brexit uncertainty clears

The Regen Premium: Homes near regeneration zones rise 3.6% a year faster

CBRE has compared property price inflation near London regeneration sites with growth in the wider local area

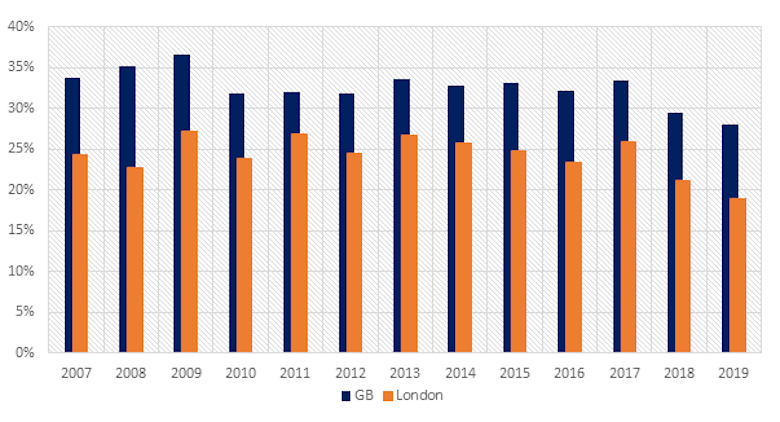

Proportion of cash buyers sinks to a record low

Investors were responsible for just under a quarter of mortgage-free transactions in the first half of this year, down from nearly a third in 2009.

Property markets to ‘remain stable’ in 2020, but prime buyers are ‘becoming less compromising’

Estate agency Jackson-Stops shares its predictions for country property markets next year