Property Market News

London’s rental market ‘remains buoyant’, say agents

Aston Chase says it has received a "significantly higher" number of rental enquiries under lockdown compared to the same period last year. LonRes data, however, tells a different story.

Seven phases to recovery: A tentative timeline for the UK resi market

The residential market is unlikely to return to full strength until 2022, says CBRE, with the post-lockdown recovery dependant on consumer confidence and the wider economic outlook;

London property buyers’ total potential spend has hit £52bn – Knight Frank

Activity may have plunged as a result of the ongoing Covid-19 lockdown, but lettings activity is on the rise and pent-up buyer demand is building, reports the agency.

How Covid-19 will reshape what prime UK home buyers & sellers want

The Covid-19 crisis could drive a "rural renaissance", reports Savills, as affluent househunters shift their priorities in light of the Coronavirus lockdown.

Prime property prices are likely ‘to display some resilience in most markets’, says Knight Frank

Bangkok, Singapore and Hong Kong saw the weakest property price performance of any prime global cities in Q1, reports Knight Frank, as the Coronavirus crisis struck first.

How Covid-19 is affecting prime property markets around the world

Savills has surveyed 50 of its top people in property markets around the world to gauge levels of buyer and seller pessimism and positivity, and assess how the Coronavirus pandemic is changing the residential…

Home-movers are ‘determined to move’, as more city-dwellers look to the regions

94% of home buyers and sellers are still planning to move once the Coronavirus lockdown is lifted, says Rightmove - but there are signs of shift in demand, with housebound house-browsers in cities looking…

Lloyds predicts a 5% fall for house prices this year

Major mortgage lender Lloyds and top-end buying agency Black Brick are both predicting a fall for property values as a result of the Coronavirus pandemic.

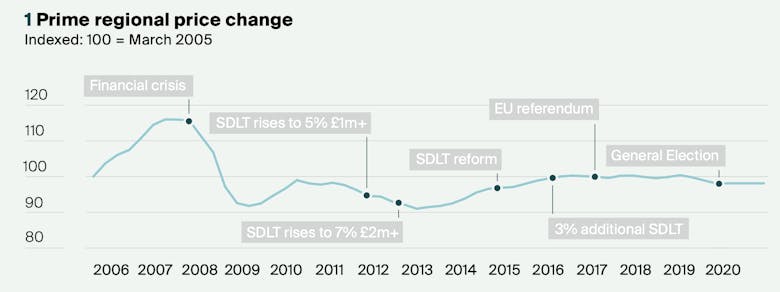

Country house market recovery thwarted

After three years in the doldrums, country house prices and activity were beginning to turn up in Q1, says Knight Frank. Now prices are likely to drop by 3% this year.

London falls out of the top ten most expensive global cities

Hong Kong is still the world's most expensive city to buy a home, according to a new report from CBRE, followed by Munich and Singapore.

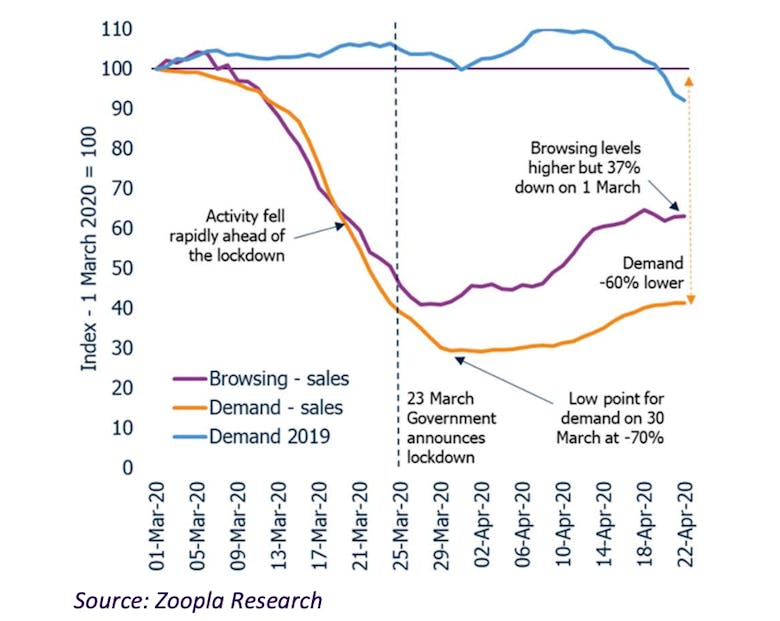

£82bn-worth of resi property deals are in ‘suspended animation’

Zoopla estimates that 50% fewer homes will be sold in 2020 than in 2019... The current rate of deals is about 10% of the usual March tally - a market more akin to late December than Springtime.

Under offers piled up as the lockdown halted prime London’s property market recovery

Nearly a third (30%) more London homes were marked as "under offer" at the end of March compared to the same time a year ago, according to LonRes data mined buy Coutts bank, as deals piled up under the…