Property Market News

Rightmove reports busiest ever day as pent-up demand is released from lockdown

Portal visits and buyer enquiries have rocketed since the property market re-opened two weeks ago, but "it’s going to take a considerable time for a return to sales agreed levels seen last year and at…

Post-lockdown surge in property demand likely to be ‘short-lived’, warns Zoopla

"Active engagement" with property listings has jumped to exceed pre-lockdown levels by some 20%, reports Zoopla - but more than four in ten would-be buyers say they have put moving plans on hold...

Overseas buyer demand grows as BoE talks of sub-zero interest rates

International buyers continue to view London property as a safe haven, says Knight Frank.

Market Snapshot: Sales & lettings listing, one week after lockdown

“One week on from the surprise opening of the housing market and agents are still showing caution and quite rightly putting safety first," says Rightmove.

Online enquiries surge in a ‘lockdown lift-off’

“This shows what happens when you temporarily suppress pent-up demand that had been building for years," says Knight Frank.

Just 2% of super-prime property listings in London are spoken for

Benham and Reeves has checked what proportion of listings are marked as sold or under offer by price bracket across prime London.

Transactions swung from a four-year high to a seven-year low in Q1

The conveyancing market experienced a rocky ride in the first few months of the year, diving from a post-election bounce to a lockdown freeze.

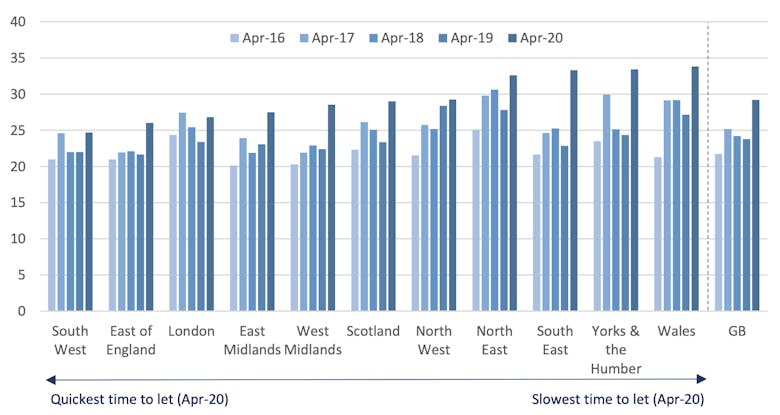

Lockdown pushes average time to let to a record high

It took an average of five days longer to let a home in April 2020 compared to April 2019, but rental demand "has now almost recovered to pre-lockdown levels," says Hamptons International.

Buyer demand bounced back immediately as the property market reopened

Rightmove points to some big potential changes in the post-pandemic property market, as many people "re-appraise their housing needs".

Why a ‘U-shaped’ recovery is more likely than a post-lockdown boom

Charlie Ellingworth and the Property Vision team take a measured look at what the Covid-19 recovery could look like for the UK's economy and real estate sector.

Surveyors reiterate call for Stamp Duty holiday following lockdown market ‘collapse’

RICS' measure of new residential property instructions fell to its lowest level on record in April (since at least April 1999).

London’s rental market ‘remains buoyant’, say agents

Aston Chase says it has received a "significantly higher" number of rental enquiries under lockdown compared to the same period last year. LonRes data, however, tells a different story.