Property Market News

Property searches surge in smaller communities as country escape continues

Country towns and villages are seeing a much bigger rise in property searches than major cities, reports Rightmove.

Rents rise in the prime commuter belt but fall in London, as tenants ‘make real lifestyle changes as a result of Covid-19’

Savills has revised its prime rental price forecasts. Prime London rents are now expected to fall by 3% this year, with inflation of +7.6% over the next five years.

Ranked: The world’s most ‘over-valued’ property markets in 2020

UBS has updated its Global Real Estate Bubble Index.

Northacre’s The Broadway tops out as resi sales ‘remain buoyant’

Super-prime developer Northacre has sold £40m-worth of apartments since April in its first mixed-use scheme, The Broadway, which has now reached full height.

Property market momentum ‘likely to carry through into next year’, despite the bleak economic outlook

Knight Frank boils down its property market analysis for the coming months into a single key question: "will there be positive news on a treatment or a vaccine before the momentum runs out?"

Property prices continue to rise in most prime global cities, but markets are weakening

The average annual rate of property price inflation across the 150 tracked cities moderated from +3.6% in Q1 to +3.4% in Q2.

Up-sizers’ average ‘trade-up gap’ escalates to £68k

Asking price inflation for three-bedroom houses has outstripped the price growth of two-bedroom flats every year for the last five years, says Rightmove.

Prime property prices outside London top pre-crash peak

Average prime values outside of London have climbed beyond their 2007 peak for the first time, says Savills, and now sit some 1.4% above their pre-crash high.

‘British house price boom to fizzle out next year’ – Reuters poll

A poll of property pundits a 2% rise for UK property prices this year, before a "flatline" in 2021.

Savills drastically raises mainstream property price & transaction forecasts

"Previous UK recessions have been associated with house price falls, but 2020 looks set to be the exception," says Savills as it "significantly upgrades" is forecasts for both property prices and transaction…

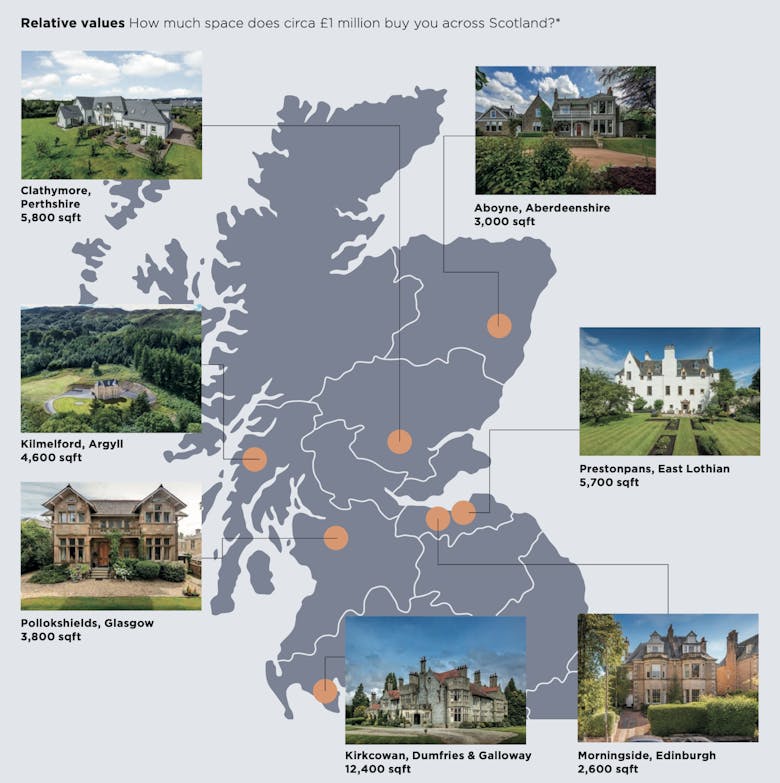

Market Snapshot: Scotland’s £1m+ market has ‘picked up where it left off’, driven by a country house revival

Edinburgh usually dominates the Scottish prime market, but more rural locations have stepped up since the Spring Coronavirus lockdown was eased.

One in eight properties sold above asking price in August

13% of homes went for more than their original asking price last month, according to Propertymark, up from 8% in July and 10% in June.