Property Market News

Falling prices & transaction volumes are ‘a blip and not the start of a permanent trend’ – Garrington

We're in "a three-way market", declares the Garrington team, as it assesses how the property market has started the year.

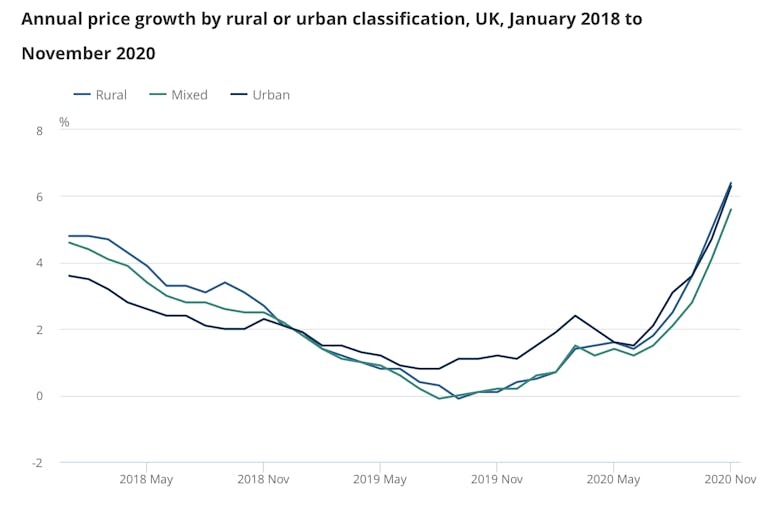

UK house prices rose by 8.5% in 2020 – the highest rate since 2014

The latest official UK House Price Index tells of significant property price inflation last year, despite Brexit and the pandemic.

The total value of property sales tumbled by 38% last year

£171.7bn-worth of homes were sold across England & Wales in 2020, down from £277.5bn in 2019.

Property owners are becoming more bullish on house price growth this year

2021's property market is likely to be "less of a roller-coaster ride" than 2020, suggests Knight Frank, as the firm stands by its forecast of 0% growth for UK house prices in the year ahead.

‘All of the key buyer metrics are [now] ahead of early 2020’ – Rightmove

Asking prices, buyer enquiries and agreed sales all picked up last month, but far fewer properties are coming to market compared to last year.

Cash deals dwindle as smaller landlords tempted to invest

Average rents in the South East have climbed by 10% in the last year, reports Hamptons - while rents in Central London have fallen by 16%.

Strutt & Parker revises property price forecasts, swinging PCL to positive growth this year

Strutt & Parker is now predicting that PCL prices will rise by up to 5% this year, having previously anticipated a drop of up to 5%...

The number of Londoners buying second homes outside the capital tripled last year

The number of London-based buyers that purchased a second home outside the capital leapt by 309% in 2020 compared to 2019, according to Knight Frank, as affluent sorts looked to escape the city.

‘Halo effect’ as renters move out of city centres

A 'space race' in the rental market is seeing houses find tenants 30% faster compared to last year, says Zoopla.

‘An unusual year’: Britain’s pandemic property market in nine charts

The ONS has produced a series of charts that illustrate what happened to the property market in 2020, from national price inflation rates to a growing preference for larger homes.

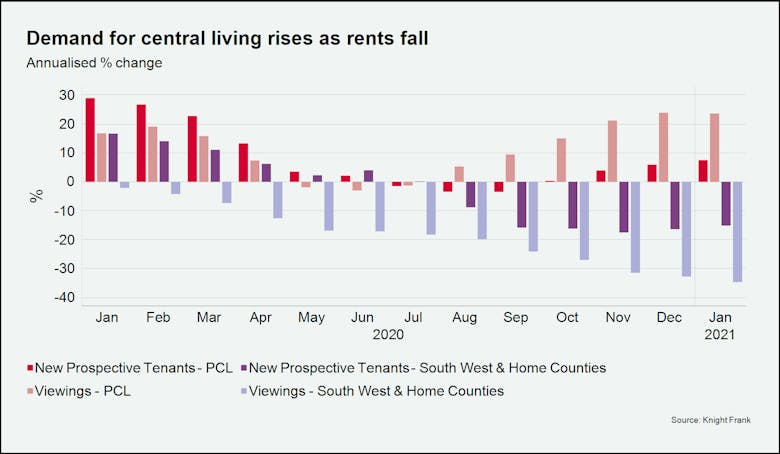

Tenants drawn to PCL as Zone 1 rents fall to lowest levels in decade

"The 'escape to the country' trend has a shelf life", reports Knight Frank, as demand for central London rental picks up.

Rightmove heralds busiest-ever January – but fall-through rates ‘creep up’

New sales supply is not keeping up with rising buyer demand, says property portal.