Property Market News

House prices: Why the risks of a fall are higher than most people think

"The fact that house prices have been rising quickly over the last year makes the market more vulnerable to external shocks to the economy," says Professor Geoff Meen, as he warns "there are numerous…

1.3 million buyers have benefitted from the the Stamp Duty holiday

"We haven’t yet seen any significant increase in properties falling through so it looks like most are going ahead regardless," says Tim Bannister, Rightmove’s Director of Property Data.

House of Lords opens wide-ranging inquiry into the housing market

The new House of Lords Built Environment Committee has launched its first inquiry, with a view to understanding "what shapes the type of housing needed in the UK as well as a range of challenges to meeting…

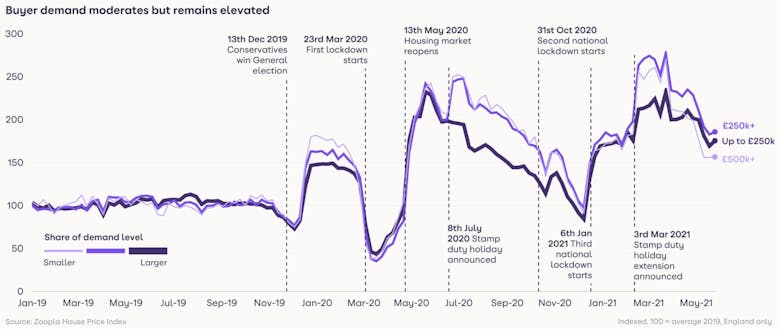

Buyer demand eases but remains 55% above ‘normal’ levels

“The stamp duty holiday boosted demand in the housing market, yet buyer demand remains elevated despite the initial holiday ending," says Grainne Gilmore, Head of Research at Zoopla "- signalling that…

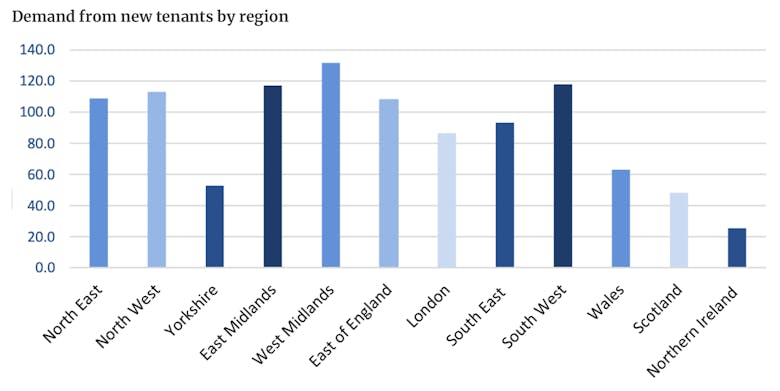

Rental demand reaches an all-time high

Propertymark member branches have an average of 97 tenants on their books, up from 82 in April. It's the highest figure on record for the month of May, significantly higher than last year's 70.

Which parts of the UK property market are likely to be most active over the summer?

Seasonality is set to return in the coming months, as the Stamp Duty holiday steps down, says Knight Frank. But which parts of the UK property market are likely to be most active over the summer?

Record number of homes selling at or above asking price

Buyers in England and Wales paid an average of 98.1% of the final asking price in January this year, reports Rightmove, marking the first time the percentage has ever exceeded 98%.

20 buyers for every property: Another record month for property demand & sales over asking price

There are now 20 buyers chasing every property on the market, according to Propertymark.

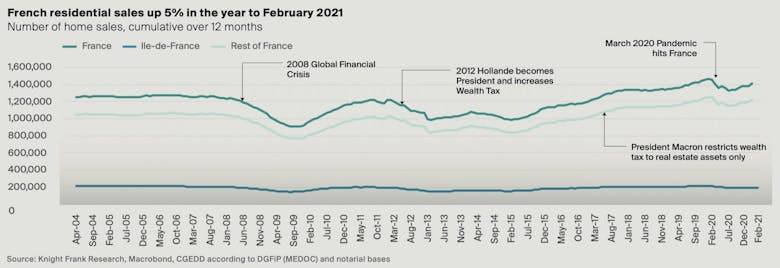

Vive la Résilience: French prime property markets hold up

France’s prime residential markets showed resilience in 2020, says Knight Frank, and has been "exuberant" for the last few months, despite the challenging backdrop...

New York is back, just ask Jerry Seinfeld

Restaurants are crowded, flights are packed, Yankee Stadium is at full capacity and corporate America is calling its workers back.

Super-prime recovery: £36.8bn is currently targeting London’s £10m+ property market

Infography: London's super-prime property market in seven charts.

Asking prices hit another record high, but ‘there are early signs of a slowing in the frenetic pace’ of the property market

Asking prices have increased in every region, reports Rightmove, with larger homes seeing the highest rate of property price inflation.