Property Market News

‘House price growth may start to tail off’ in the next few months, says OnTheMarket boss

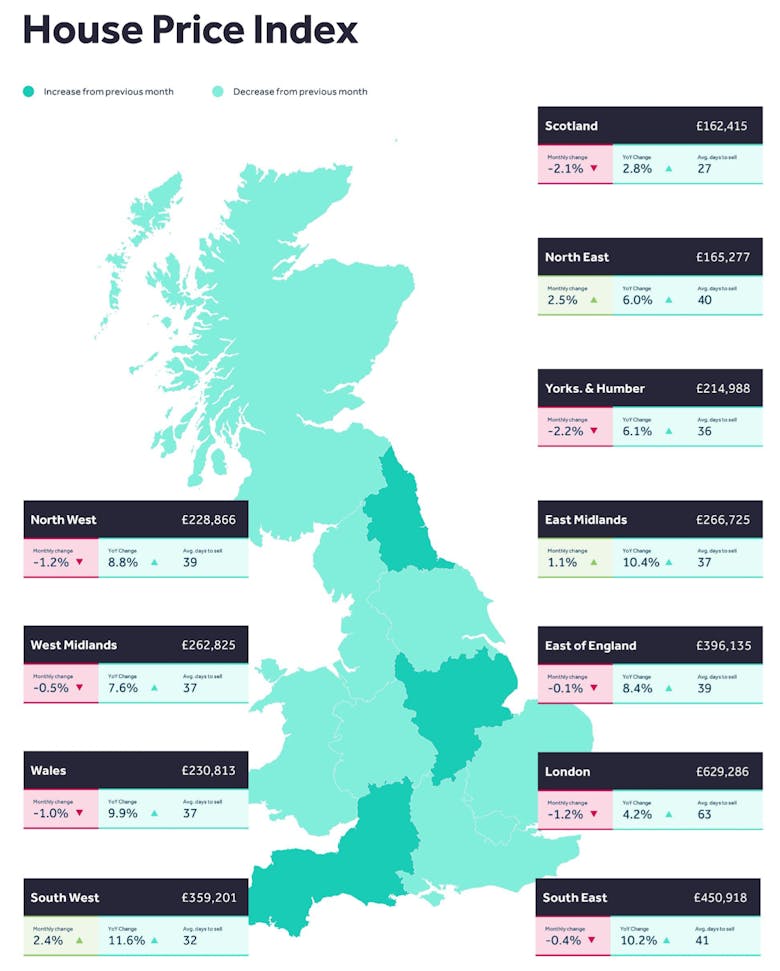

The average asking price of a property listed for sale outside London on OnTheMarket in December was £364k, up 3.7% from the same month last year. Within Greater London, the average asking price was £1.

Super-prime property sales hit record highs in London

“London’s super-prime markets stellar end to the year is evidence of the influence that the pandemic-fuelled desire for more space has on residential markets," says Savills.

Rightmove reports busiest ever start to the new year

"Early-bird sellers who got themselves ready to come to market are now benefitting from the busiest start to the year that we’ve ever recorded," says Rightmove.

London & Cornwall vie to be Britain’s most searched-for property location

Rightmove recorded just 3% more property searches in London than in Cornwall through 2021, compared to a gap of 24% in 2020, and 49% in 2019.

Lucian Cook on house price forecasts: Deciphering the messages in 2022

Savills' head of residential research reflects on how forecasters translate actions and events into numbers and trends to come up with property market predictions for the year ahead.

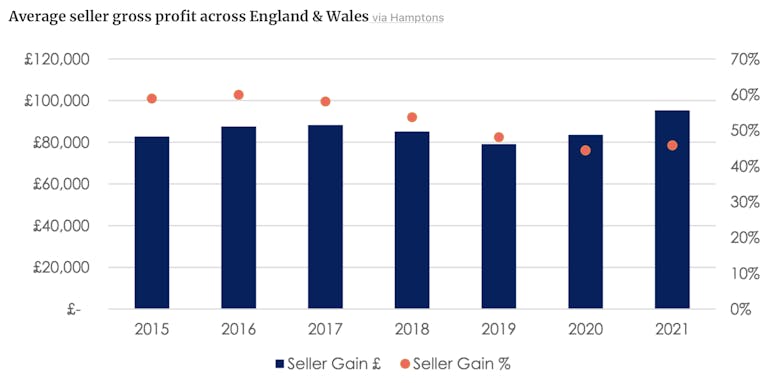

The average 2021 vendor sold their home for 46% more than they bought it for

A record 92% of sellers sold their property in 2021 for more than they bought it, according to Hamptons, having owned it for an average of 8.8 years.

Scotland’s prime property market set to stay hot in 2022

“We’ve seen significant competition for homes throughout the year and I can’t see that changing in 2022,” says Edward Douglas-Home, head of Scottish residential at Knight Frank.

Country houses out-performed in 2021, but PCL’s property market is primed to ‘bounce rapidly’ this year

Savills expects prime regional price growth to moderate this year, while Prime Central London prices feel ready to surge upwards.

Prime London rental growth hits a decade high as ‘lockdown trends continue to reverse’

Savills and Knight Frank have both reported surging rental prices in Prime London, as tenants return to town.

‘Vintage year’ for the prime country house market as top-end prices surge 20%

“I’ve never known a time like it in 30-plus years," says Rupert Sweeting, head of national country sales at Knight Frank.

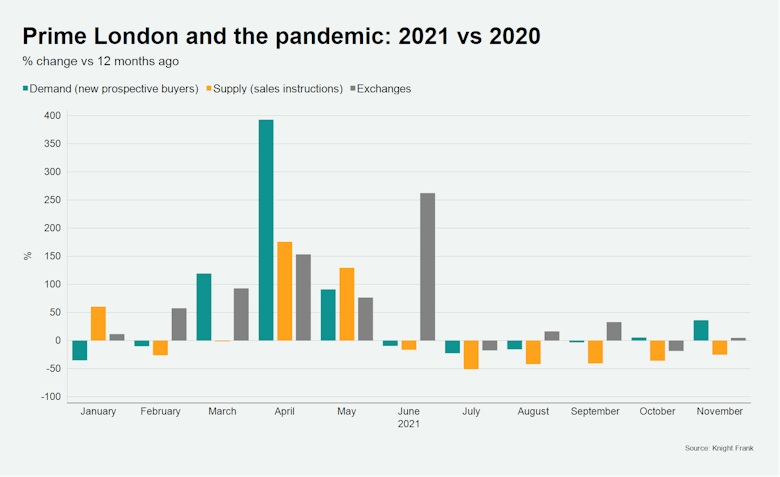

Omicron puts prime London’s property market ‘at a crossroads’

Property prices in prime outer London are rising at their fastest pace since February 2016, according to Knight Frank's latest index.

Londoners spent a record amount on homes outside the capital in 2021

"2021 is likely to mark the largest outmigration from London for at least a generation," says Hamptons' research chief.