Market Index

‘Rental stock slump is close to bottoming out’ – Hamptons

City centre rents are rising fast as stock levels drop, says Hamptons, although the national headline rate of rental price inflation continues to ease.

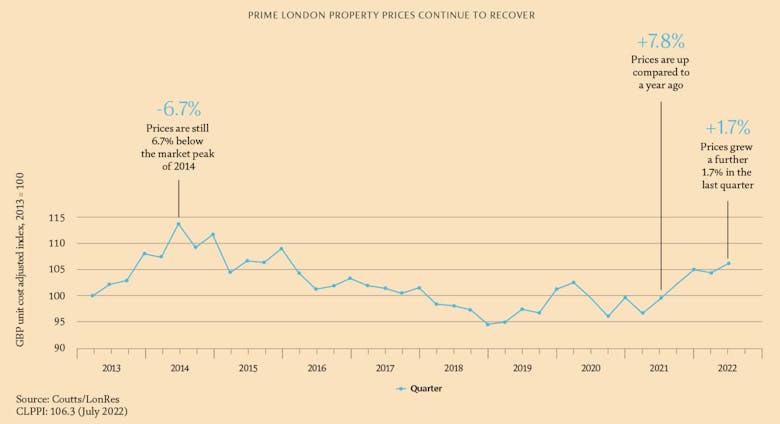

House price growth slows to +7.8%

The average UK property price increased by 1% from May to June this year, according to the latest official House Price Index.

Sharp drop in confidence amongst London property sellers

"The change in economic headwinds is starting to be reflected in seller confidence," says OnTheMarket.

Traditional Summer dip sees asking prices fall for first time this year – Rightmove

"Prices usually drop in August, and this 1.3% drop is on a par with the average August drop over the past ten years," explains the Rightmove team.

House prices continue to climb despite falling buyer demand – RICS

"It is little surprise that housing market activity is now losing some momentum," says the RICS - but most surveyors "still anticipate prices will be modestly higher than current levels in a year’s time.

‘London’s prime property market is getting back on form’ – Coutts

High-society bank tells affluent clients that PCL is back in action.

‘Signs are already emerging that housing delivery rates could slow considerably’, warns Knight Frank

“New residential development is being constrained by a limited supply of land coming through the planning system.

‘The winds of change are blowing through global property markets’ as price growth slows

Knight Frank's latest international index tells of cooling housing markets around the world, including at the top end.

Property market ‘is not slowing as fast as some might expect’ – Zoopla

Property portal predicts house price growth will slow to 5% by the end of this year, but buyer demand remains high in the face of rising interest rates and costs of living.

Prime resi prices continue to climb in major global cities

US cities have seen the highest rates of prime property price growth in the last six months, reports Savills, as the firm predicts a slight slowdown across most world cities in the second half of this…

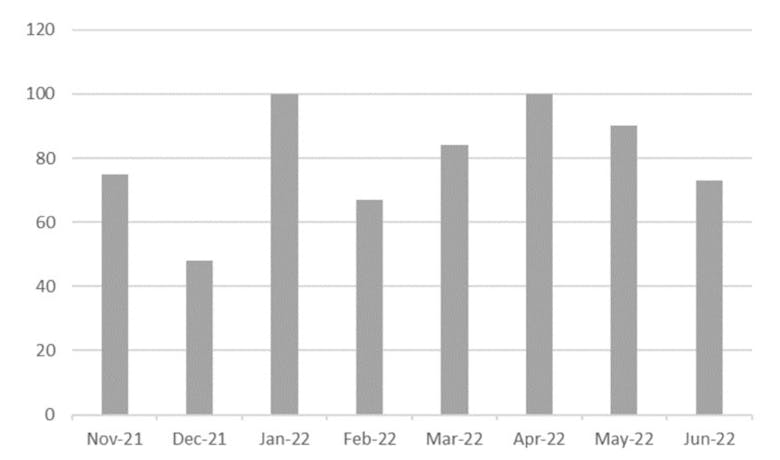

Lettings supply improves, but not enough to quell rising rents

Estate agents have seen rental stock levels climb steadily since February - but "this barely scratches the surface on what is needed in order to limit the ever-widening gap between supply and demand,"…

Property market moves ‘back to normal’ as Summer heat cools – Propertymark

Another market index tells of slowing buyer demand and less pressure on house prices.