Market Index

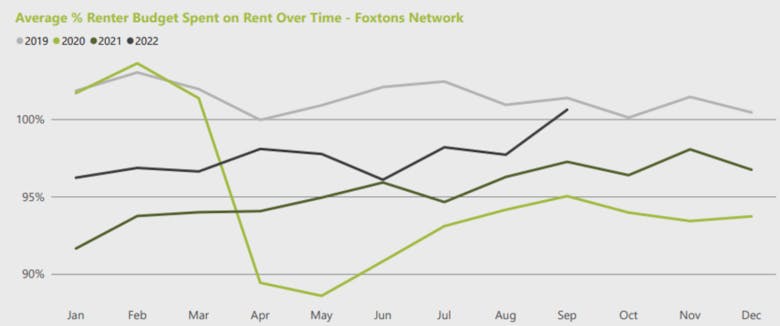

London rents reach a record high as supply shrinks and demand climbs

Foxtons has listed 38% fewer rental properties so far this year compared to last, while tenant demand is running high.

Global housing markets are ‘at the tipping point’, warns UBS, with ‘significant price corrections’ imminent in many world cities

'We are witnessing the owner-occupied housing boom finally under pressure globally,' says UBS, which warns of 'significant price corrections' in a majority of the highly-valued global cities in the coming…

‘Storm clouds clearly visible’, warns the RICS as ‘dial shifts’ on the housing market

The property market 'has clearly shifted in a negative direction', says the RICS' Chief Economist, with surveyors expecting house prices and transaction volumes to fall in the coming months.

Most home-buyers & sellers ‘remain undeterred’ by property market turbulence

One in six home-movers have changed plans as a result of recent mortgage market catastrophising, according to a London estate agency's latest survey, but the majority of buyers and sellers remain 'level…

Prime global rental growth ‘has peaked’

Knight Frank's latest Prime Global Rental Index shows a slight dip in the pace of luxury rent inflation across ten international cities.

Prime Central London property prices and rents continue to climb

'We sense increased downward pressure on both prices and activity in the year ahead' for mainstream property markets, says JLL's research chief - 'but we don’t think this is necessarily the path the…

London’s prime property market shows ‘signs of a slow but steady return to health’ – but super-prime sales struggle

Demand for £2mn+ homes in London continued to climb in Q3, according to analysis of property portal data, while a lower proportion of open-market £10mn+ properties are finding buyers than last year.

Homebuyer demand eases across the country

A lower proportion of property listings were marked as sold in Q3 this year than last, reports GetAgent - with Bristol and London the only places to see an increase.

‘Intense’ tenant demand fuels record prime rental growth in London

Current growth rates 'cannot be sustained,' says Savills, as its prime lettings index records the highest annual increase since it started in 1979.

Property sales supply picks up, but still out-paced by buyer demand – Propertymark

'The number of properties available to buy is recovering from the mad dash we had before,' says Propertymark boss Nathan Emerson.

The rental market is ‘a pressure cooker getting hotter’ – Propertymark

77% of letting agents reported rising rents in August, says industry trade body.

The housing market ‘is slowly transitioning to a buyers’ market’ – Zoopla

Higher mortgage rates are reducing home-buying power by "as much as 28%", warns property portal.