Market Index

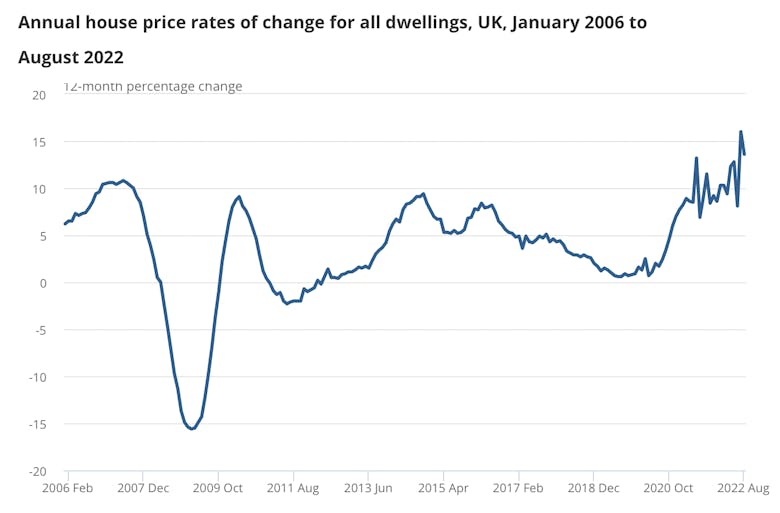

House price growth slows further, to +9.5% – UK HPI

London no longer has the lowest annual rate of house price growth of any UK region, according to the latest official index.

Under-offer numbers down in Prime London as buyers & sellers put their moves on hold

The number of properties put under offer last month was below the pre-pandemic average for the first time since June 2020, while fall-throughs were up by 80%...

Architects ‘are grappling with persistent challenges’ as confidence falls further – RIBA

Private residential is the most pessimistic design sector about future workload prospects.

‘It is clear that we have returned to a much more price-sensitive housing market after two years of a buying frenzy’ – Rightmove

Asking prices drop 'in line with the norm' despite financial uncertainty.

Competition for London rentals is running 40% higher than at this time last year

Foxtons is reporting an 'unusually busy' end to the year for the capital's rental market.

Property sales ‘continue to stall’ while rental market picks up steam

A 28-month run of rising house prices has come to an end, reports the RICS, as buyer demand tails off and transactions stall.

Higher mortgage rates set to erode house price ‘paper gains’ next year – Zoopla

'Homeowners wanting to sell in 2023 will need to be realistic on price and may have to forgo some of the pandemic price gains to achieve a sale in 2023,' says Zoopla's research director, Richard Donnell.

Asking rents in London have jumped by 16% in the last year

'It’s a real challenge for renters at the moment,' says Rightmove, 'as there are simply not enough homes available to rent to meet the demand from people enquiring.'

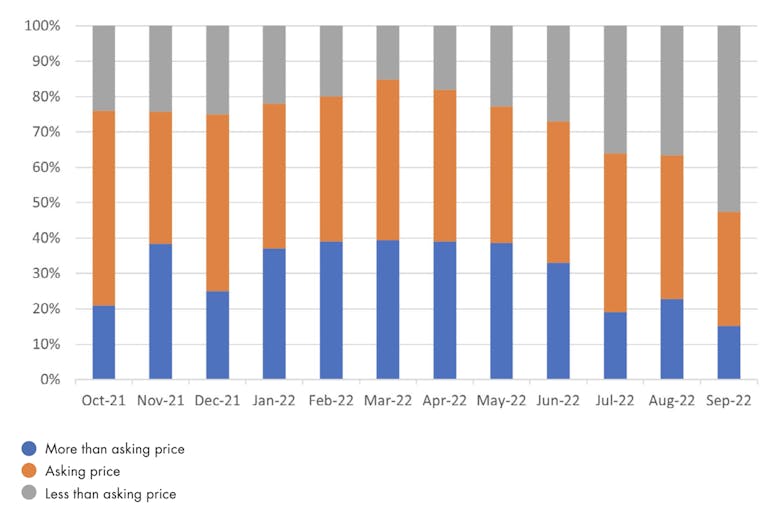

Property sales supply jumps by 50% – Propertymark

"The extreme pressure may be coming off the market, but it has a long way to go yet before we see it return to normal," says Propertymark, as supply improves but demand remains high.

Annual house price growth slowed to +13.6% in August – UK HPI

The latest official House Price Index shows "a slight cooling in year-on-year growth, but it’s far from being a blizzard," comments Jackson-Stops boss Nick Leeming, while Knight Frank points out that…

Home-buyer & seller sentiment ‘remains robust’, says portal

'There’s evidence that buyers feel the market is moving in their favour,' says OnTheMarket boss Jason Tebb, as the portal reveals results of its September Sentiment Survey - conducted before the now-unravelled…

Asking prices continue to climb as some buyers pause while others rush deals through

'The vast majority of buyers who had already agreed their purchase are still going ahead,' says Rightmove, but some buyers 'have had their plans dashed by the sudden nature of the mortgage rate rises.