Market Index

Savvy buyers snap up ‘Christmas bargains’ as competition drops by a third

'The sales market is firmly back in the hands of buyers,' says Propertymark.

London house prices dip but the wider property market remained robust in October – UK HPI

London's average house price fell by 0.9% in October, according to the official UK House Price Index, while the national average property value nudged up by 0.3%.

Prime London property buyers ‘are hesitant but haven’t disappeared’

Knight Frank's latest analysis of the prime London property market tells of a clear slowdown in buying activity - but a price crash seems unlikely.

Rightmove predicts 2% drop for house prices next year

Asking prices are falling as 'sellers who are determined to find a buyer quickly adjust their expectations and adapt to a less frenzied housing market,' says Rightmove, as the portal predicts a 'relatively…

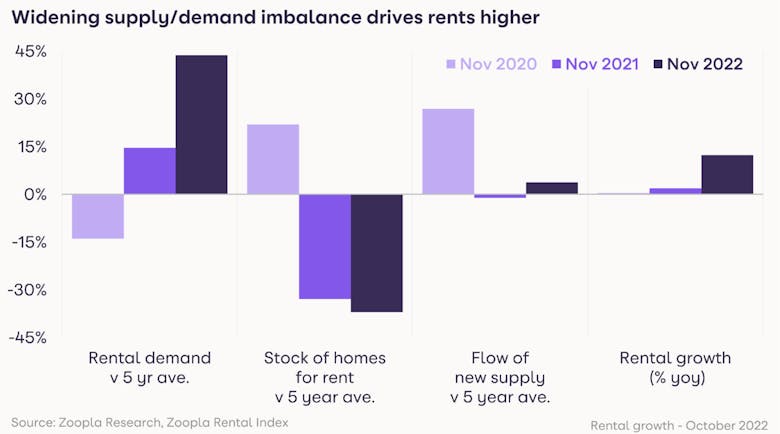

‘Chronic lack of supply’ drives rents up 12% in a year

Zoopla expects rental price growth to calm down next year, despite continued low stock levels and high tenant demand.

Global house prices continue to rise, but are falling in real terms

Knight Frank's Global House Price Index showed an 8.8% increase in the year to Q3, down from a peak of +10.9% in Q1 2022.

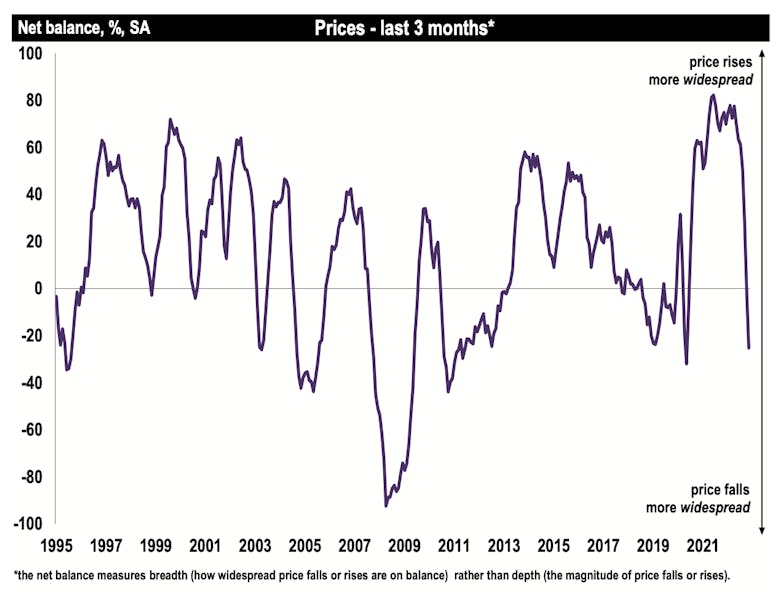

House prices fall as the property market continues to slow – RICS

'The downturn in the housing market this time could be shallower compared with past experiences,' says Simon Rubinsohn, Chief Economist at the Royal Institute of Chartered Surveyors.

London’s super-prime property market ‘has very much found its feet again’ as transaction levels remain high

Spending on £10mn+ homes in London has reached a seven-year high, leading Knight Frank's Rory Penn to suggest that 'for now, the super-prime market in London has very much found its feet again.'

‘House price inflation is losing momentum fast’ as home-buyer demand plunges 44% – Zoopla

"A widespread repricing of housing underway," says Zoopla, as buyer demand sinks and more vendors cut asking prices.

Prime rental yields hit a decade-high

Knight Frank has flagged a clear increase in high-value properties hitting the rental market since the ill-fated 'mini Budget'.

Properties sell faster as buyers’ minds ‘focused’ by rising interest rates – OnTheMarket

'It seems astonishing that despite macroeconomic headwinds, and predictions from many estate agents that property prices will fall next year, serious sellers and buyers alike remain keen to proceed,' says…

Supply and demand dip as property market chills

'We are on the cusp of seeing the sales market hand back purchasing power to buyers,' says Propertymak, 'which is a trend we haven’t seen in months as the market was very much in the seller’s favour.