Market Index

Prime rental price growth slows as the market becomes ‘less frantic’

Savills expects prime London rental growth to calm from its double-digit run to +5.0% over 2023 and +3.0% by the end of 2024. The prime commuter belt is set for an even sharper slowdown.

Rightmove reports ‘a more encouraging start to the year than many anticipated’

Property portal notes 'tentative sign of stability' as asking price rise in January after two negative months.

Record-breaking rental growth continues, with central London rents up 15% on the year

'2022 has been a record-breaking year for rental growth,' says Hamptons. 'But even so, rents have failed to keep pace with wider inflation, and indeed landlords’ rising costs.'

Home-buyer demand across England dropped 9% in Q4

'The pandemic-inspired property boom is being brought well and truly back down to earth,' says GetAgent after assessing the proportion of homes listed for sale that have already found a buyer.

Mortgage approvals drop to lowest level since June 2020

Fewer house purchase mortgages were approved in November 2022, as interest rates climbed.

Scottish country houses move back to ‘a healthy, normal market’

Knight Frank brought in 50% more Scottish country house sales instructions in November compared the five-year average.

‘High value properties continue to outperform across the board’ as equity-rich & mortgaged markets diverge

Prime Central London's property market is looking resilient in the face of the economic downturn, says Savills.

Prime London property prices are ‘in a holding pattern’ until Spring

Knight Frank saw a sharp drop in offers bing made on prime London properties towards the end of 2022 - but offers accepted and exchanges were well up on previous years.

‘Little sign of more balanced conditions’ in prime London’s lettings market

Rental supply and demand remain very mismatched in the capital - but Knight Frank suggests that 'the UK property market may finally begin the process of self-correction' later this year.

Home-buyer demand has fallen by 50% as the race for space ‘runs out of steam’

London property prices have fallen over the last five years and are likely to drop further in 2023, says Zoopla.

Prime global rents continue to climb, but the pace of growth is easing

Luxury rental values in New York, Singapore and London have bounced back hardest from pandemic lows, according to Knight Frank's latest index.

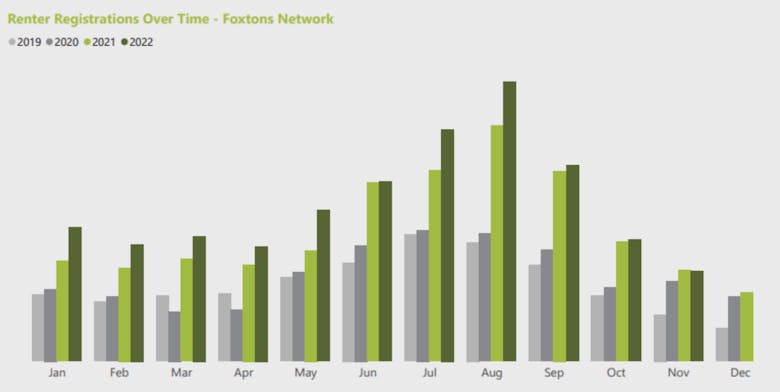

London’s lettings market cools, but average rents are still 20% higher than last year

Average rental prices in the capital fell by 3% last month, says Foxtons, in line with a normal seasonal slowdown.